Category Archives: Risks

It isn’t over until it’s over – part 2

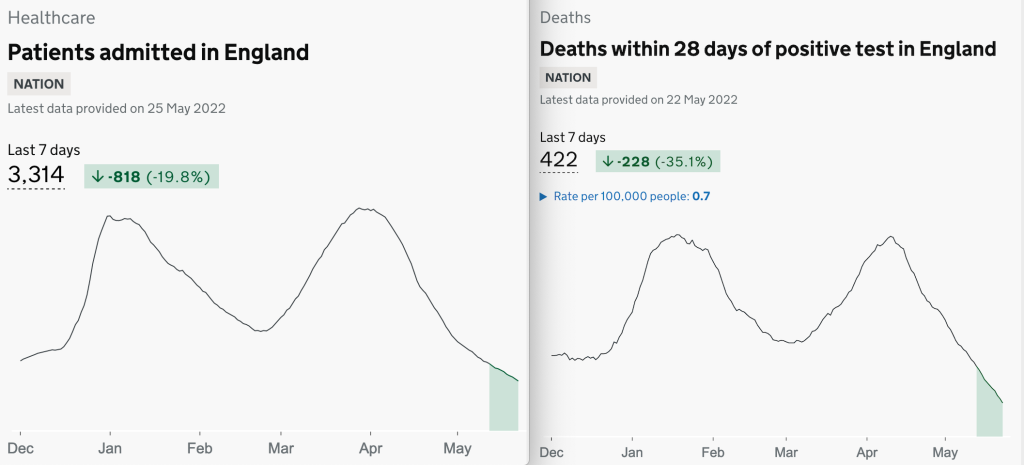

I should possibly be more of a Pollyanna presently, but I just have an unhealthy tendency to think about the opposite of conventional wisdom. Case in point is Covid-19. It’s over right? Finished. Finito. Probably. But cases are still significant all over the world. This includes the US and the UK and while the overall trend is undoubtedly downward, but you should know by now what I think about trends when it comes to predicting the future. Bit useless.

I might also add that in China the situation is a bit dystopic. The natives are getting restless (can you still say that?). Putting aside global supply chain disruption and the possibility of a significant global economic downturn (caused as much by worker absences than by covid-per se) there’s the whole Russia/Ukraine situation (which appears to have accidently created a united Europe and a warp-speed green energy revolution – who saw that coming?)

But my main worry currently is that there’s a remote possibility that the virus might significantly mutate again (and again). I must say I was relaxed about this until a virology Professor pointed out to me that the ever-weaker strain theory is just that, a theory. There is no proof of this being the case (note to self: stop talking to virology Professors). The bottom line is that IF a seriously nasty mutation occurs, we may have to start all over with vaccines and lockdowns, although I very much doubt whether there’s much appetite for the latter.

And China. I’ve always talked about China being much more fragile than many people imagine. They have a significant demographic imbalance in terms of the number of young men in their population.

If China has economic growth in high single digits or teens and these men have jobs, apartments and what have you, then all is fine.

Dream of getting rich, but just don’t criticise the ruling party.

But if an economic slowdown occurs (caused either by internal issues or, more likely, external factors – remember China is still currently beholden economically to external demand – then these young men might get mightily pissed-off.

T2. (You’ll have to work out what T2 means for yourselves. Suffice to say that if I spelt it out, this post might piss certain people off).

One of the best bar charts of all time

The Covid-19 line is dreadful, but I actually think the suicide line is worse in some senses.

Corona is not a Black Swan Event

There is a narrative slowly emerging that Corona (Covid-19) is a true Black swan event. For example, according to Fred Cleary, a portfolio manager at Pegasus Capital, quoted in the FT’s excellent Long View Column, “Covid-19 is a black swan”. I could be wrong, but from recollection of reading the book, a Black Swan event is something that people cannot possibly imagine and therefore cannot possibly predict.

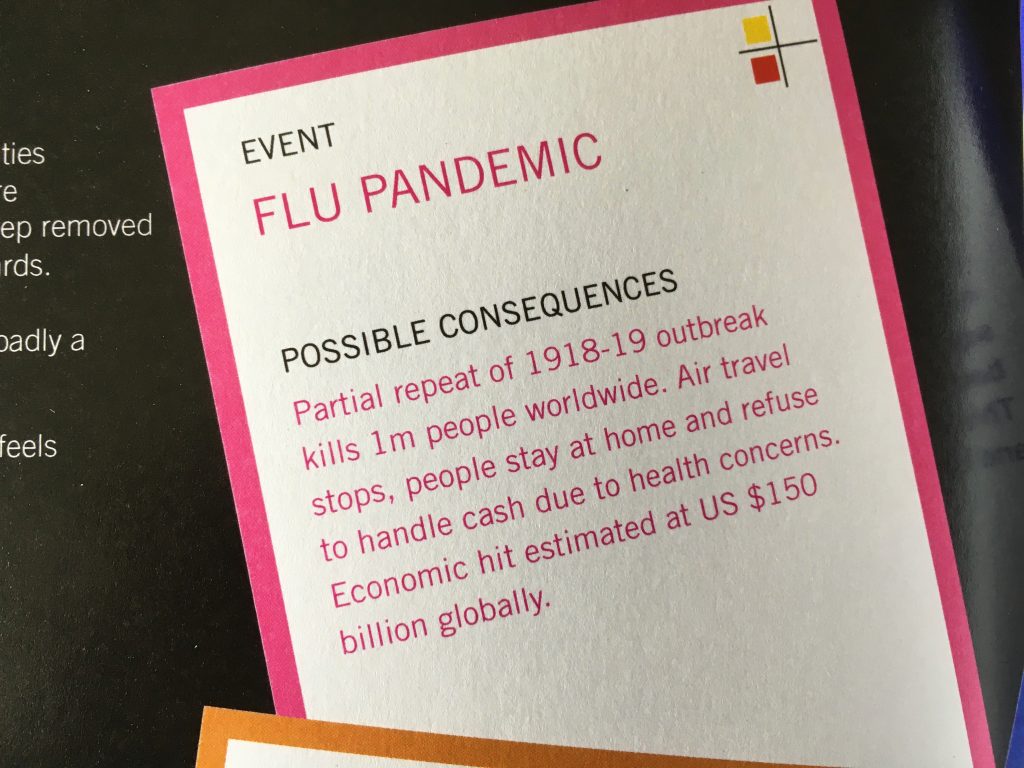

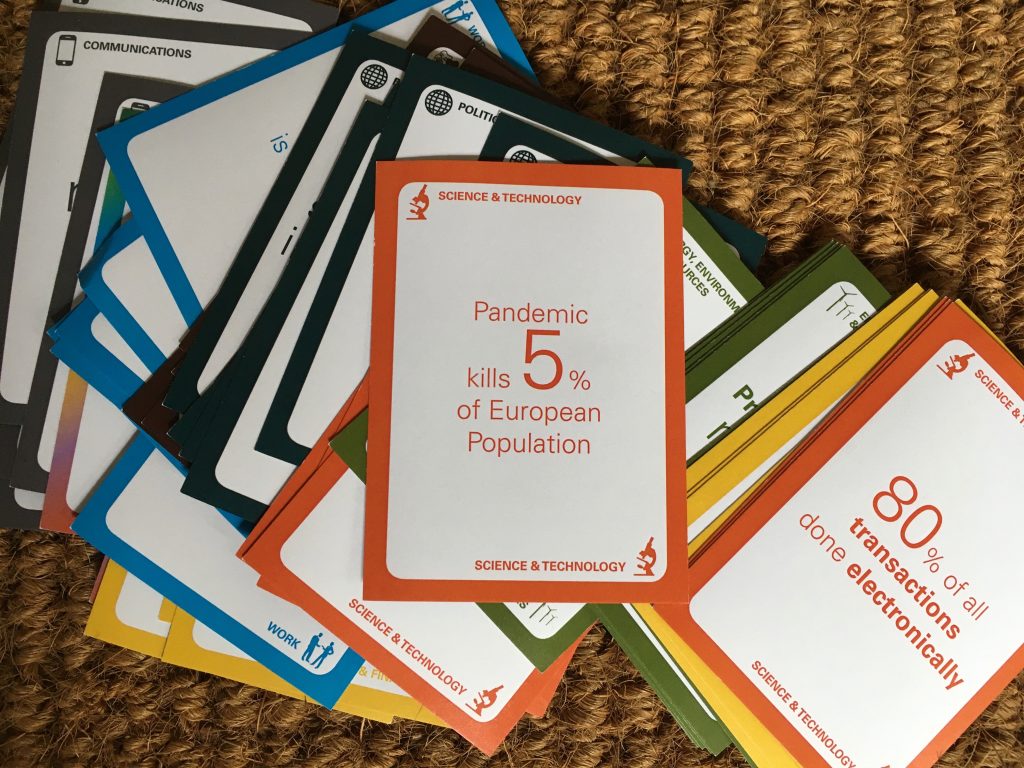

9/11 was a Black Swan event. Corona virus is not. In scenario-speak it is a wild card event that breaks all scenarios, but this is most definately not something that has not been foreseen. I worked with an Australian bank back in 2005 and a pandemic was on the table so to speak. It was one of the main topics of a UK government risk workshop in 2015 (by main topic I mean it was one of the events considered most probable (when not if as they say), it featured in some strategic trends work with the UK Ministry of Defence too (again, as a strategic shock), in some library scenarios, some work for KPMG and finally some disruption cards created with Imperial College.

The problem, of course, is not predicting, forecasting or foreseeing, but in assigning probability to such events or ideas. If the probability is widely considered to be low it will be largely ignored. It also touches on not what, but whom, in the sense of who gets listened to, why and when. BTW, is this is all a bit doom and gloom, my view is that the current pandemic is quite mild in terms of mortality. This too will pass, although next time we may not be so lucky.

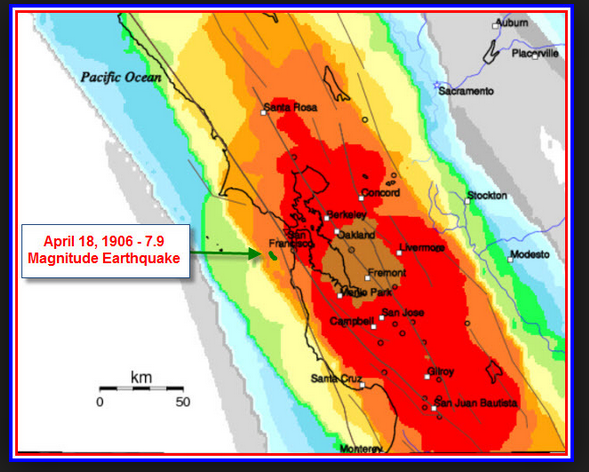

What if..? (Major Earthquake + Silicon Valley)

I was at a Lloyd’s Insurance event last night and the subject of a major Californian earthquake came up in conversation (not if, when). I’ve written about mega-quakes before, but what ‘ve I’ve never really thought through is the location of Silicon Valley relative to the major fault lines. OMG.

Map key:

San Andreas Fault: Green

Hayward Fault: Yellow

Rodgers Creek Fault: Purple

Calveras Fault: Red

Concorn-Green Calley Fault: Blue

Greenville Fault: Orange

San Gregorio Fault: Black.

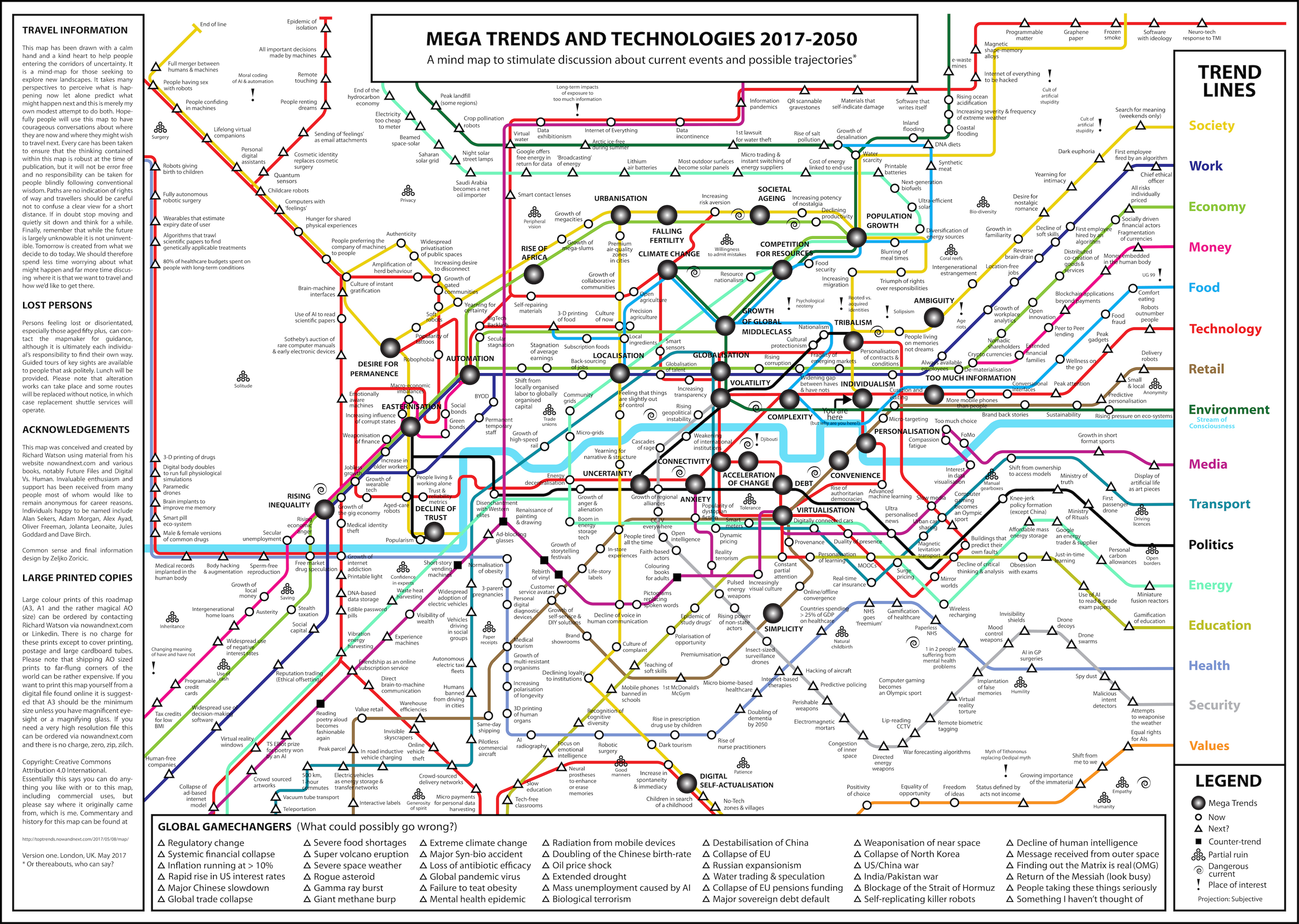

Map of Global Mega Trends

Here you go then. Use this link to get to a high resolution version. A3, A1 and rather wonderful AO sized copies on paper are available upon request (no charge except for print, post and a cardbaord tube). See you in the future.

The Search for Intelligence (here on earth)

A real scenario?

I was going to add this as book of the month in brainmail, but I figured it was a little depressing. Here is fine, of course! One for the scenario thinkers at the Ministry of Defence and MI5 perhaps?

A State of Fear: Britain after a Dirty Bomb by Joseph Clyde.

Joseph Clyde is a pseudonym of George Walden btw, a former diplomat and government minister. The book is a novel

Amazon link here.

The Wildest of Wildcards

A few years ago someone came up to me after I’d given a speach at a risk conference and said that I was missing a wildcard risk. He proceeded to tell me that the world would change if we gained the ability to communicate with animals. The risk would be that they might not be happy with what we were doing to our (their) planet.I thought it was a good wildcard/risk, but not one we need worry about too much.

So a few years on and I’ve just picked up a book called Pulphead by the American writer Jeremiah Sullivan and randomly opened it at page 309. The chapter is titled Violence of the Lambs and it’s about how animal behaviour is possibly changing, possibly in reaction to climate change or the continued encroachment of the human species. In short, what might the biological endgame be for some of the more evolved animal species?

What we are talking about here is essentially animals attacking humans. Like Hitchcock’s The Bird’s, but with bears, wild dogs, chimps, elephants and killer whales as well as crazed seagulls. If you remember what happened to Steve (Croc-hunter) Irwin with a ray you might get the idea. The chapter, indeed the whole book, is worth a read.

A scenario for the future of insurance

Here’s a true story. A few weeks ago I decided to take one of my old cars for a run. It’s a very old car and if it isn’t run regularly things start to go wrong with it. It was the first dry day in weeks, although there was a heavy frost. The run was fine, although it wasn’t long enough so I decided to extend it. Long story short, I hit some black ice on a bend. I wasn’t travelling fast – 20mph perhaps – but I ended up on the wrong side of the road in front of a van coming directly at me at a similar speed. We missed each other, but I ended up in a hedge and did quite a bit of damage to my car.

Here’s an alternative scenario. My insurance company is well aware of the weather in my area. In fact they’ve been alerted by three local drivers that they’ve hit trouble. So when I open my garage, or possibly before, I receive a text saying that there have been three accidents in the area in the last few hours and it’s recommended that I don’t take the car out until any ice has melted. Maybe I’d get a tiny discount for not driving my car on this particular day.

In the future insurers will have a far better understanding of risk, much of it in near real-time, because of the devices we constantly carry around with us – phones especially – and due to ubiquitous smart sensors. Eventually there will trillions of these tiny sensors reporting on just about everything all of the time. The data these devices capture will be used to predict behaviour, which will be used to cluster pools of customers and aggregate risk, but also to personalise policies to single individuals and companies. Eventually these sensors will be mandatory in all vehicles and it will be impossible to get insurance cover without them.

The nature of this data will allow insurance companies to vastly reduce risk by warning customers to avoid certain situations, again in real time. This could be purely punitive, but more likely insurance companies will ‘game’ their customers to nudge them in various virtuous directions. Thus insurance companies will move from risk recovery to risk avoidance. This will further blur the distinction between real life and virtual life and insurance companies will cover virtual assets, information and identity as much as they cover physical assets.

Digitalisation will allow new pricing models and payment options too. For example, travel or life insurance will mostly be bought by the day – or even by the second – and the cost would be dynamic, responding instantly to changing context and variables. If it looks as though a tourist is straying into a risky part of town they might receive a text telling them so. Or perhaps their insurance company will notice that they’re away from home and ask for an increased premium or suggest that since they aren’t driving the family car for a while the reduced risk be transferred into cash-back or would result in a discounted travel policy.

If a customer is skiing and the weather looks nasty it would be possible to buy cover on the spot on a ski lift using a phone, but also to link to other skiers on the mountain to assess the risk locally and possibly cover it via the crowd. This might be ‘sold’ to users on the basis that it’s a little like online gambling.

An individual on the lift might also receive a text from Google saying that their latest weather data, together with known data about the individual’s left knee, would suggest that additional medical cover would be sensible if the individual is not wearing augmented reality ski goggles that display hidden hazards. Or maybe the text comes from the travel company, the ski-maker, the ski boot maker or the ski clothing company, all of which are connected to the internet. All companies, regardless of what they make, are now in the information business and offer added-value services direct to their customers.

Similarly, cars, even before they’re autonomous, will collect data on not only real-time driving conditions, but on the behaviour of the driver and other drivers in the vicinity. The telemetry and data analysis used by F1 teams now will eventually be available to everyone.

If a car noticed that a driver was driving erratically it could ask other connected devices for an explanation. The drivers bed might report that the driver had very little sleep the previous night so the car would automatically adjust its safety controls as a result. Insurance costs might be increased until the driver had a good nights sleep.

Of course we shouldn’t forget pets. These will be fitted with collars or embedded sensors that track physical activity and perhaps link to known food purchasing or consumption habits. This will allow for personalisation and the identification of overweight animals and owners.

Homes will be wired and intelligent too, with buildings automatically reporting on their condition and that of any significant object and appliance within. For example, inadequate heating would impact the cost of cover as this may in turn affect frozen pipe risks. Medical insurance would be much the same – constant real-time data reporting on the condition of insured individuals, perhaps with updates based upon daily exercise, food intake, pill consumption and any recent medical interventions. This would be augmented with genetic information about each individual. Any deviation from an agreed policy condition (a sneaky cigarette or too many jam donuts) would void cover, although good behaviour would open up a series of added value benefits and services – the use of certain hard to see NHS medical professionals or access to low-risk robotic surgeons. Expect Apple, Google and Vodafone to all be active in this area.

Most customer contact and pricing will be through mobile devices and this will itself see a high degree of automation with renewals simply requiring customers to press ‘9’ if they would like to renew a policy. Robotic insurance advisors and salespeople will also become commonplace.

How would all this be possible? Beyond the ubiquitous digital connection of individuals and objects, one very big change will be the disappearance of cash. All purchasing will be digital and will therefore record what is being bought, by whom, where and when. Once such modelling becoming precise it will be possible to offer customers cover across all risks with payment that’s constantly changing, much as a domestic utility bill is related to how much of a particular resource is used.

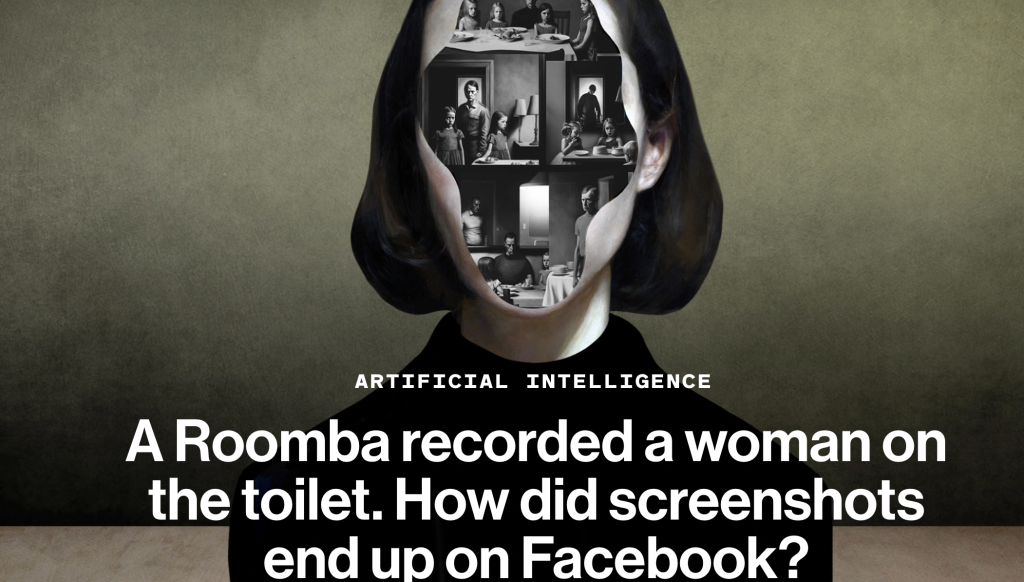

However, the ownership of all this data, much of it reporting on previously unseen, unobservable or private behaviours, will be extremely valuable and this is where the potential scenario breakers come in.

Firstly, whose data is this anyway? If the data is valuable individuals and institutions may demand full or partial payment beyond the payment in kind currently afforded by low-level personalisation.

Secondly, privacy. Will individuals and institutions be happy to let others see or share the data relating to their behaviour, especially when it becomes far more apparent how this data is being collected and how it’s being used and in some cases sold?

Third, security. Perhaps on-going problems relating to data hacking, identity theft or government surveillance will result in a significant move away from smart sensors and big data.