There is a narrative slowly emerging that Corona (Covid-19) is a true Black swan event. For example, according to Fred Cleary, a portfolio manager at Pegasus Capital, quoted in the FT’s excellent Long View Column, “Covid-19 is a black swan”. I could be wrong, but from recollection of reading the book, a Black Swan event is something that people cannot possibly imagine and therefore cannot possibly predict.

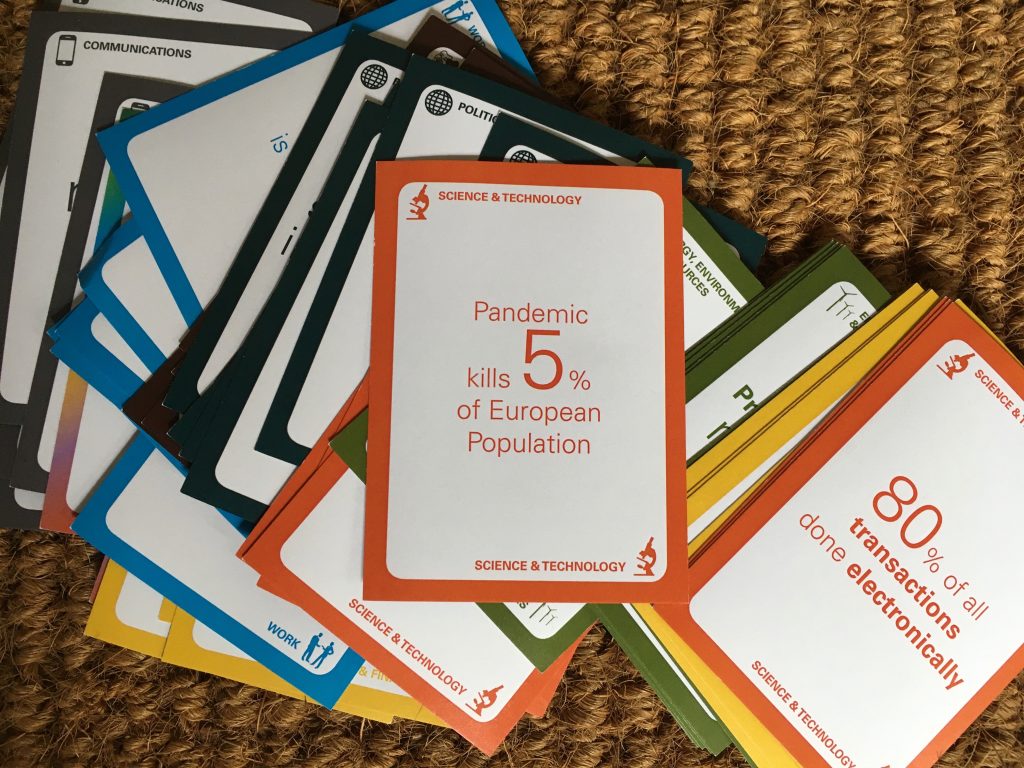

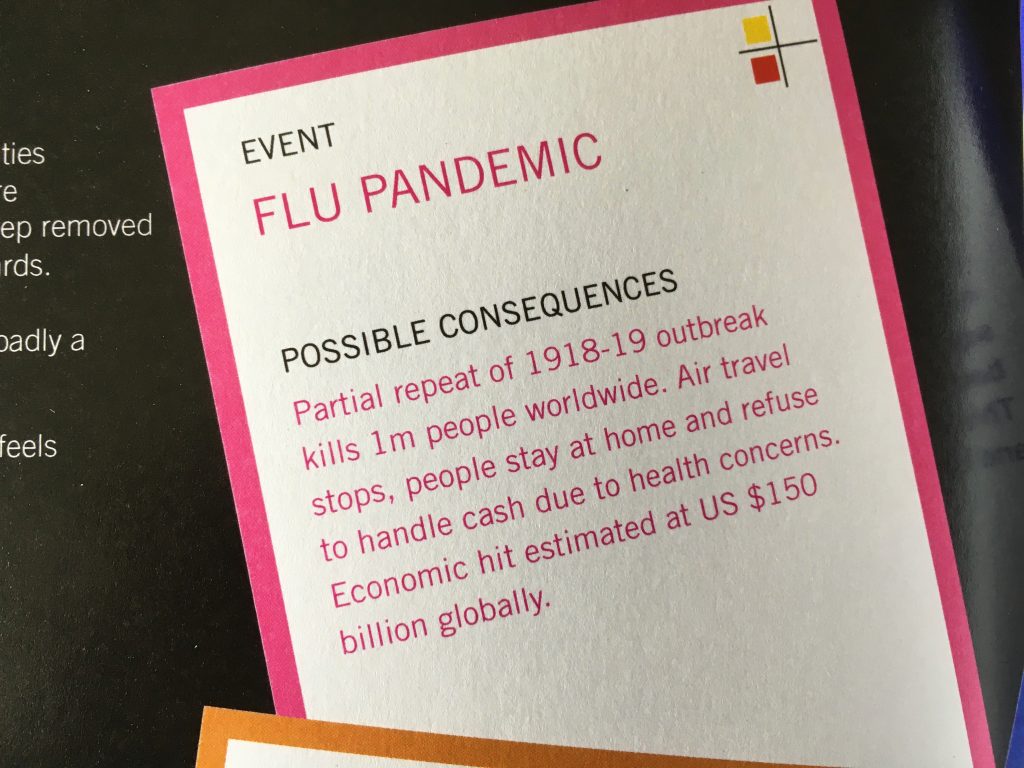

9/11 was a Black Swan event. Corona virus is not. In scenario-speak it is a wild card event that breaks all scenarios, but this is most definately not something that has not been foreseen. I worked with an Australian bank back in 2005 and a pandemic was on the table so to speak. It was one of the main topics of a UK government risk workshop in 2015 (by main topic I mean it was one of the events considered most probable (when not if as they say), it featured in some strategic trends work with the UK Ministry of Defence too (again, as a strategic shock), in some library scenarios, some work for KPMG and finally some disruption cards created with Imperial College.

The problem, of course, is not predicting, forecasting or foreseeing, but in assigning probability to such events or ideas. If the probability is widely considered to be low it will be largely ignored. It also touches on not what, but whom, in the sense of who gets listened to, why and when. BTW, is this is all a bit doom and gloom, my view is that the current pandemic is quite mild in terms of mortality. This too will pass, although next time we may not be so lucky.