It’s getting very close (and very complicated).

It’s getting very close (and very complicated).

21 Things that are being killed off by digitalisation

1. Memory

2. Privacy

3. Experts

4. Concentration

5. Listening to a whole album

6. Punctuality

7. Telephone directories

8. Cheap watches

9. Letter writing

10. Spelling

11. Printing photographs

12. Copyright

13. Personal re-invention

14. Plagiarism

15. Reflection

16. Paper money

17. Paper statements

18. Airline tickets

19. Concert tickets

20. Landline telephones

21. Intimacy

:and 7 things that aren’t

1. Public libraries

2. Vinyl record shops

3. Newspapers (look at the data globally)

4. Physical banks

5. Meetings

6. Paper

7. Church

Inspired by Inspired by 50 Things that are being killed by the internet

http://www.telegraph.co.uk/journalists/matthew-moore/

So it seems that wikipedia has lost its mojo; most postings now seem to be headlined with quality caveats that make it feel like they’ve been overrun by a swarm of lawyers. What I’m sure drove it’s appeal in the early days was that remarkable sense of collective wisdom that built up so fast; now they seem to be struggling to break through another threshold of quality, so powerfully demonstrated by their own disclaimers.

I guess they’ve also become victims of their own success; the Thierry Henry ambushing is pretty funny, but clearly leads to even more of the corporate crackdown behaviour that puts sincere contributors off. Maybe crowd sourcing isn’t a lasting phenomenon after all; undone by the spoilers and corporate killjoys in equal measure.

BTW, talking of things that have lost their mojo is seems that things at Apple are getting a little rotten. Take the new iPhone. It doesn’t work. It’s a great computer but it’s a useless phone. Did Apple realize this and ship the product anyway? As for their customer service the less said the better.

Of course there is a better explanation for all this. I remember some research ages ago saying that when a company made it onto the cover of a magazine it was usually a few months away from disaster. Equally, when a company was written about as “doomed” it was usually moments away from a recovery. Apple is currently sitting in the #1 spot as the “most admired company in America”. You do the math.

PS – Full disclosure. Wayde did the first half of these words. I liked them so much I stole them (with permission).

…among your columnist’s acquaintances was a child who had never been outside of Copenhagen and hence burst into tears at the sight of a tray of cress…

Future Orientation (Copenhagen Institute of Future Studies) issue #4 2009

If you use social networks you are 30% less likely (than a non-user) to know your next-door neighbour.

Ref: Pew Research Center/New Scientist (14/11/09)

I like this statistic too…

If current trends hold, China’s urban population will expand from 572 million in 2005 to 926 million in 2025 and hit the one billion mark by 2023.

Ref: McKinsey Global Institute

“The average per-person consumption rate in the first world of metal and oil and natural resources is 32 times that of the developing world. That means that one American is consuming like 32 Kenyans.The problem is not the number of Kenyans, the problem is when Kenyans or, more pressingly, big developing countries such as China, gain the ability to consume like Americans.” – Jared Diamond (in the FT).

Who says you can’t predict the future:

Here’s a passage from the original edition of my book, Future Files, published in 2007 (so written in late 2006).

“Transparency and regulation will increase across other areas of financial services, too, which will significantly increase operating costs for financial institutions and will put many smaller players out of business. And don’t expect the customer – however stupid and shortsighted – to take responsibility for their actions either. We will see a significant increase in litigation against banks, and insurance companies because “you made me have it” and “I didn’t realise interest rates would go up that much.”

Here’s something from a certain Karin Upton Baker, who is defending herself against legal moves from Challenger Managed Investments and Perpetual Trustees. According to newspaper reports, Upton Baker says that “lenders should never have let her owe them $18 million because they knew she was not earning enough to repay it. Ms Upton Baker, who earns $360,000 a year as the Managing Director in Australia of the luxury goods brand Hermes, has also admitted she did not read the terms and conditions of her mortgages and that she falsely declared that she had received financial and legal advice before she took out the loans.”

So, basically, any profits Ms Upton Baker makes on real estate trading are privatized, while any losses she makes are socialized? I must remember to add ‘personal responsibility’ to my extinction timeline.

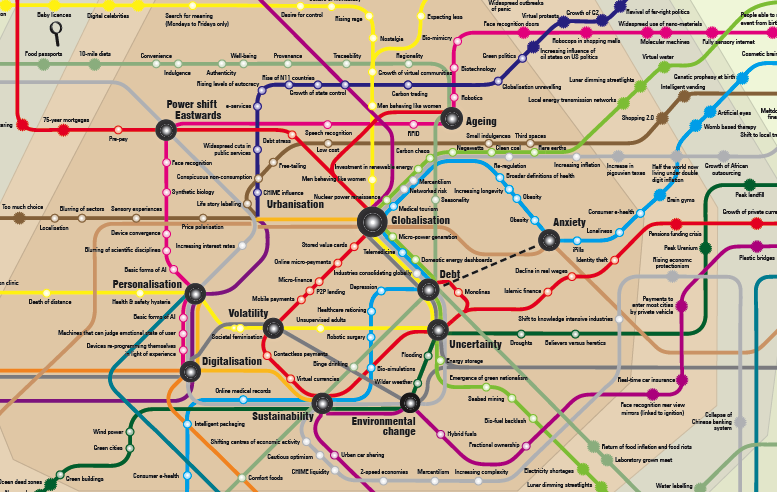

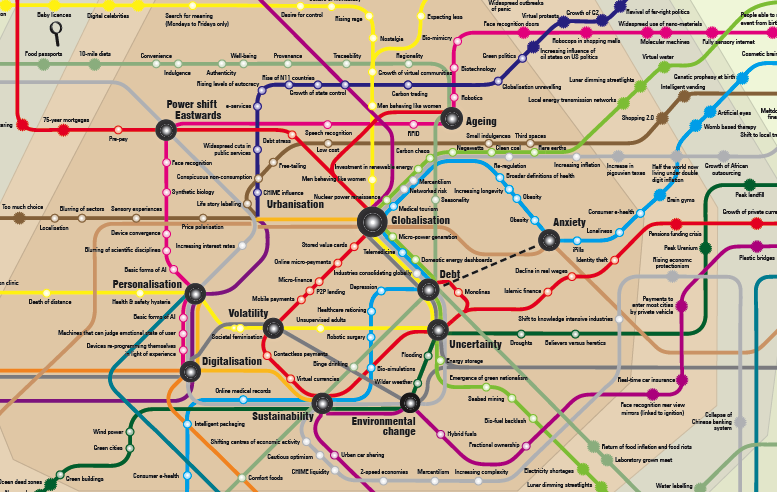

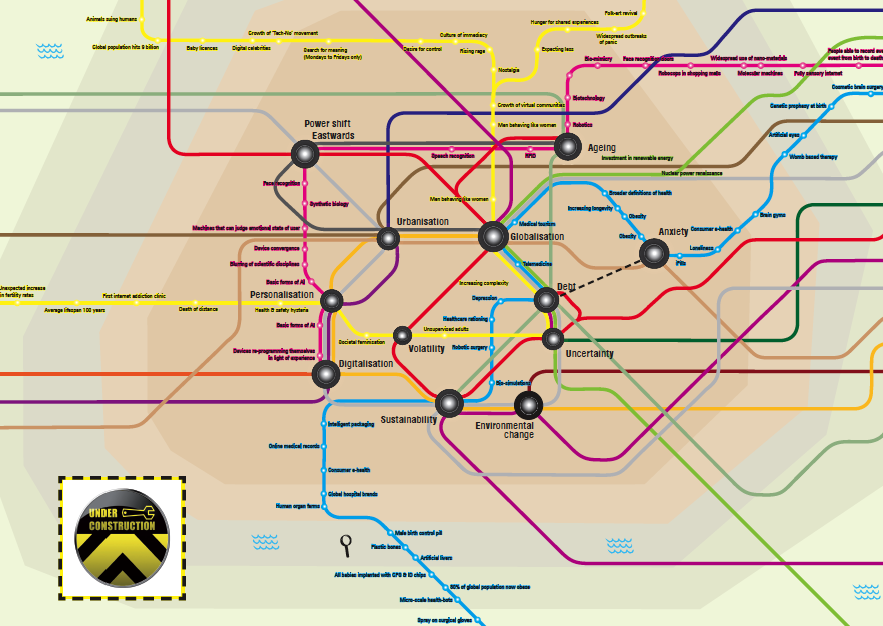

The map is slowly coming together – and yes I know you can’t read it yet! When it’s almost done I’ll stick a readable version up on beta for comment.

Society

Zone 1

We not me

Expecting less

Health & safety hysteria

Nostalgia

Search for meaning (Mondays to Fridays only)

Aspirationfor control

Growth of virtual communities

Culture of immediacy

Men behaving like women

Women behaving like men

e-erosion of empathy

Flight to the physical

Hunger for shared experiences

Unsupervised adults

Slow cities

Green cities

Rising rage

Constant partial stupidity

Societal feminisation

This. Delete: The Value of Forgetting in the Digital Age by Viktor Mayer-Schonberger. Takes the privacy debate to a whole new level.