Future Vision was officially launched today in Australia. I blogged the preface a while ago, so here’s a tiny bit more (part of the forward from an early version) as promised. If you want to buy the book here’s the Amazon/Kindle link.

Forward: into the unknown

Several years ago, an office worker in Tokyo dropped dead at his desk and wasn’t discovered until five days later. This was despite the fact that his co-workers regularly walked past and said “hello.” In a similar incident, a fifty-one-year-old had a heart attack in an open plan office in New York on a Monday morning, but nobody noticed the fact that he was dead until the Saturday, when a cleaner attempted to wake him up to ask whether he was working over the weekend. Apparently it wasn’t unusual for the man to be there because, according his boss, without any hint of irony, “he was always the first to arrive and the last to leave.”

Is this the future? Is this how things will eventually work out for many of the so-called free agents inhabiting anonymous desks inside vast corporations or for the emerging class of digital nomads electronically tethered to virtual offices via a compote of Blackberries and Apples?

The answer is no. It is one possibility. It is one future, but there are many others.

One future might be a cross between Terry Gilliam’s film Brazil and Fritz Lang’s Metropolis. This would be a dystopian future where people are forced to work longer hours for larger bureaucracies in a futile attempt to earn more money to offset rising food prices, higher energy bills, declining real wages, increasing debt and disappearing retirement. Conversely, people might willingly choose to spend more time inside lifeless cubicles at work because, while the work is mind numbing, they feel increasingly isolated and uncomfortable at home.

This could be because the family, as a building block of society, has atomised and more people are living alone, or because a relationship hasn’t turned out as planned and work offers more satisfaction and companionship. Add a pinch of ubiquitous media, autocratic data-driven governments, brain-to-machine interfaces, GPS, RFID, facial recognition, genetic prophesy, predictive modelling and CCTV and, while this future isn’t quite like Orwell’s 1984, the date could be seen by some to be getting closer not further away.

Alternatively, we might see a move in a totally different and much more utopian direction. Maybe we’ll start to see that there’s more to life than dropping dead at your desk and people will start to fight for the right to re-balance their lives in their favour. Perhaps automation – especially robotics and artificial intelligence – will finally deliver on its promise of a leisure society and people will spend more of their time re-connecting with their families and doing more of the things that really interest them. This could also be a world where the state limits freedom of choice in areas such as healthcare and pensions and provides a higher degree of security in return for higher direct or indirect taxation. A sustainable world driven as much by the heart as the head, where local forces start to push back against globalisation and where new technologies are carefully scrutinized for long-term social impact and value. An ethically driven world where physical community is rediscovered and corporations are restrained due to, amongst other things, skills shortages, the high cost of energy and limited raw materials.

A world not dissimilar, in many ways, to the one described many decades ago in Ernst Schumacher’s book Small is Beautiful: Economics As If People Mattered.

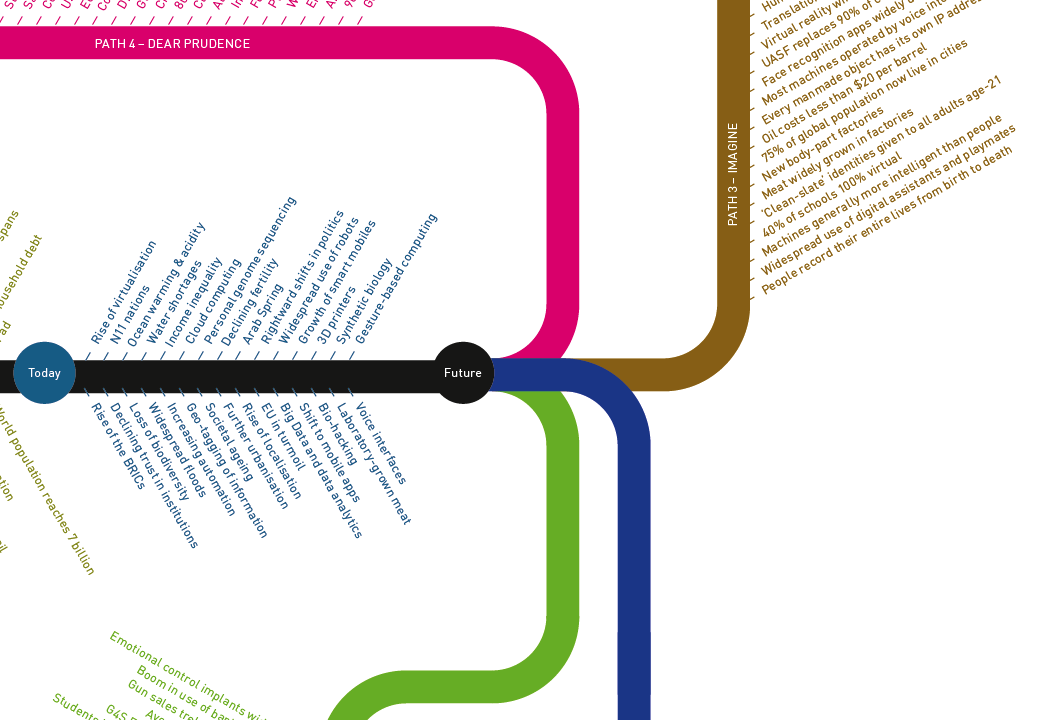

And there are many other possibilities, many other paths and many other futures too. How, for example, might oil costing upwards of $200 per barrel change the world? Perhaps people and products would move around less or the high price of food would lead to an unexpected decrease in obesity. What if we invented a new technology based upon photosynthesis that made energy almost free? What if a new ideology capable of challenging free-market capitalism were to appear? Or if the next Russian Empire decided to broaden its borders beyond their current limits. Or what could happen if the heavy use of mobile phones (of which there are already more than 5 billion worldwide) started to cause the death of tens of millions of young people through brain cancer after a long and largely invisible gestation period?

There are many ways in which we can think about the future and looking at the past (i.e. how we got to where we are today) is a good place to start, partly because what happens right now can influence what happens next and also because both are often related to what happened a very long time ago. And there is a third reason. By understanding the complexities of how we got where we are today we will be better served in how we think about the future. Complexity is the name of the game. Of course, history is not always the most reliable guide to the future because nobody owns the facts. The way we interpret the past can cast a long shadow that hides other important facts. Similarly the future can be buried in the fringes of the present, which essentially means that knowing precisely where to look, or who to talk to, can pay dividends and give you a head start compared to less creative and less curious thinkers. Whichever way you look at it, it’s worth remembering that the future is always present.

This is not to say that the process of thinking ahead is not fraught with difficulties, but a bigger problem is time. Thinking seriously about worlds to come takes time, which is in very short supply nowadays. As a result, many organizations focus almost exclusively on short-term issues, which means that reactions are often too immediate and management often consists of racing from one crisis to the next. More often than not, especially in commercial organizations, the focus is on the next 12 weeks (the next financial quarter) or the next 12-months (“results”), which are then compared to the last 12-months. Thinking beyond this, especially 36-months or more ahead, is almost unheard of. As a result, deep questions, along with longer-term opportunities and risks, tend to go unanswered until its too late. And this anomaly is not just a ‘business’ issue. How many of us defer thinking about pensions and superannuation until way past the ideal start date? The economic rise of China went unnoticed by many for many years. In the ‘nineties, world economic forums would get excited by China but then revert to the old concerns about NATO, Japan and the tensions in Europe. But now, while the opportunity is slowly being seen, the risk of a potential reversal, with associated bubbles and concentration risks, is not. The same could be said for fertility or the impact of social media on democracy.

History, as the author and security and intelligence expert George Friedman has pointed out, “can change with stunning rapidity.” If the Chinese economic miracle were to come to an abrupt end, this would create a very different future, parts of which we can instantly imagine if we only put aside the time to do so.

Put in a slightly different way, while there are many trends and traits that at first glance look set to continue for the immediate future, nothing is ever certain – a thought, crisply echoed by the writer JG Ballard, who once said that: “If enough people predict something it won’t happen.” On the other hand we are well aware how expectations are realised in the performance of stock markets so it’s never all one thing rather than another. In fact our favourite word is ‘and’ rather than ‘or’.

The history of prediction is interesting in this context and is littered with false prophets, much as it’s strewn with false profits, and it is important to distinguish between what is probable with what is possible. The best way of doing this is, as the detective Sherlock Holmes once pointed out, is to start by removing whatever is totally impossible and then, whatever is left, no matter how improbable, must be considered as being possible. There is also a technique developed by the Strategic Trends Unit at the UK Ministry of Defence in which probabilities are assigned to specific words. “Will” is assigned a probability of “Greater than 90%” “Likely/probably” is “Between 60% and 90%”, “May/possibly” is “Between 10% and 60% “and “Unlikely/Improbable” is “Less than 10%” However, this is never easy to do. Probability is of little value when engaging with the future, even if we had the time and effort to undertake quantitative analysis. The future is not at the end of a trend line. No wonder then that so many individuals cling resolutely to the past. It’s much easier that way. Similarly, it’s hardly a surprise that so many institutions structure themselves to deal with the immediate present. It’s much cheaper that way.

But by the time the relevant strategies are in place, the horse has bolted and we are already somewhere new. Most organizations create strategies to deal with yesterday’s problems . But thinking about the distant future is essential if we, as individuals or organizations, are to take full advantage of the myriad of opportunities that lie ahead.

Developing a situational awareness for emergent risks is absolutely essential if we do not want to end up standing on the wrong side of history on an ongoing basis. In our work with organizations world-wide, we have also come to the conclusion that workable short-term strategies have the longer-term embedded within.

All well and good, we can hear you saying, but how can one sell the idea of futures thinking to an organization run by an individual that is focused on that set of numbers that will take shape over the next 12 weeks? The honest answer is that you can’t. However, if you are fortunate to work for an organization with an incoming or outgoing head there is hope because these leaders are either concerned with creating a vision or leaving a legacy and both of these mindsets fit rather well with futures thinking.

Furthermore, dark clouds have silver linings. In our view a critical function of leadership is to embrace the plurality of opinions – of diverging worldviews – in order to have a better chance of making sense of the future. The recent history of reactions to climate change is a case in point. If an organization is facing an extinction event (i.e. new technology, government regulation or customer mindsets mean that current products, services, business models or margins appear doomed) this is precisely the time when closed minds are opened up to new possibilities.

One of the features of good leaders is that they have an understanding of past and present. They understand the historical reasons for failure and success, but also appreciate some of the challenges that lie immediately and more distantly ahead. Outstanding leaders do something else too. They have a vision for the more distant future. More often that not, they see things that others cannot, and while their visions maybe partially obscured they are often able to create and communicate compelling stories about why other people should follow them down a particular road.

This skill can work extremely well, but this too can contain a fatal flaw, which is that individuals and organizations can sometimes end up being held hostage to a particular point of view, or vision, of the future. The more dominant a leader – or organizational culture – the more that people will be drawn into agreeing with a particular point of view and the less that people will seek to challenge either it or the hidden assumptions upon which it’s built. The more credible or powerful a source the less likely we are to think that something they say maybe wrong. The more popular or widely circulated something is the more likely we are to agree with it, especially if we are busy.

Let’s get back to the two dead bodies. Both of the stories about workers dropping dead at their desks were featured in newspapers and TV channels around the world, including The BBC and The Guardian. They were widely circulated on the Internet too. But both were untrue….

(continues)