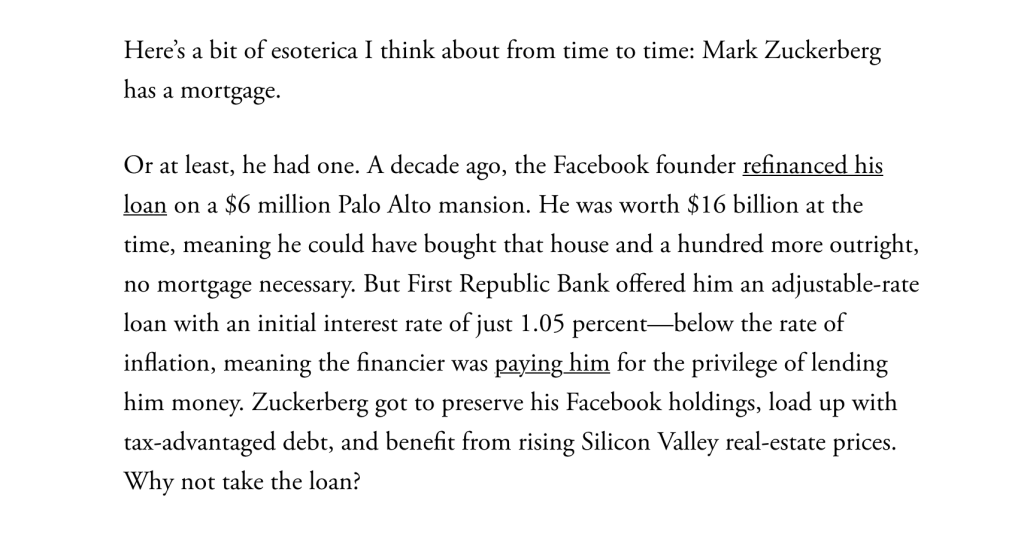

Now that’s how you open an article or a book in my view. Great article on inequality in the Atlantic – a fine read if you donlt know it. https://www.theatlantic.com/ideas/archive/2022/06/asset-economy-high-interest-rates-inflation/661323/

Now that’s how you open an article or a book in my view. Great article on inequality in the Atlantic – a fine read if you donlt know it. https://www.theatlantic.com/ideas/archive/2022/06/asset-economy-high-interest-rates-inflation/661323/

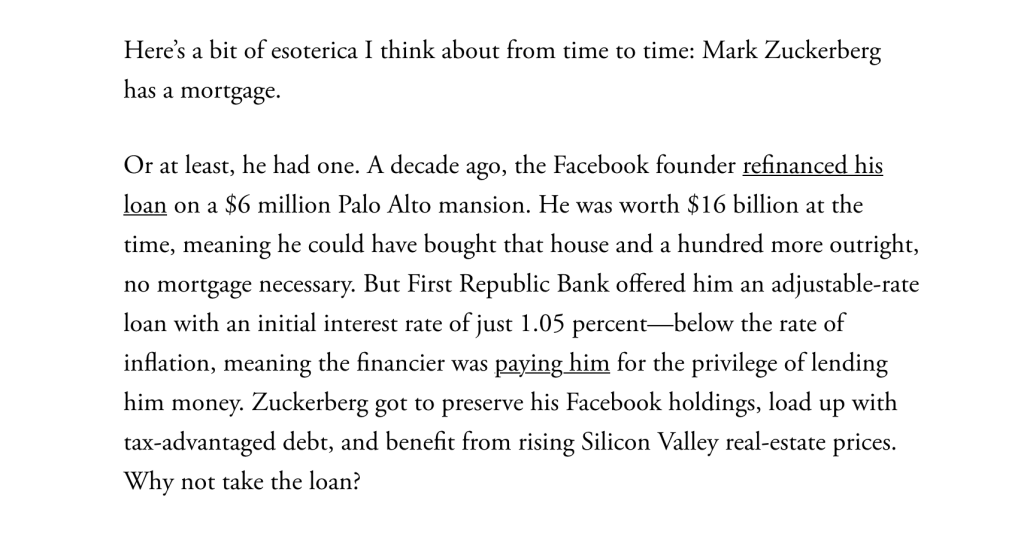

My joke 3 years ago that the EU might fall apart before Britain had left is starting to look semi-serious. I do believe that the world, especially Europe and the US, is one shock away from a major meltdown. This could be triggered by a a major political or economic event or triggered by irrational emotional contagion. Fasten your seat belts folks, the ride is about to get bumpy.

My joke 3 years ago that the EU might fall apart before Britain had left is starting to look semi-serious. I do believe that the world, especially Europe and the US, is one shock away from a major meltdown. This could be triggered by a a major political or economic event or triggered by irrational emotional contagion. Fasten your seat belts folks, the ride is about to get bumpy.

A couple of things nobody seems to be thinking about. First, there have been calls for a second EU referendum for a while and the prospect seems more serious with the Labour Party perhaps backing the idea at, or before, the next election. The idea, and it’s a weak one in my view, is that people didn’t quite know what they were voting for last time or people were misled. Sounds just like any election I can remember. But what if there is a second vote and the result is leave again? Then what? The assumption seems to be that a second vote would result in a different result. Not necessarily.

My second wildcard thought is what happens if we have a financial meltdown before 31st October? Could this create an EU collapse before Britain has left the EU?

There’s a book called the Levelling by Michael O’Sullivan, an analyst at Credit Suisse, and in it he argues that globalisation has stopped, Economic growth is weak to non-existent and the next natural dip is long overdue in countries like the US and China. Central banks have accumulated too much power, QE is distorting markets, especially bonds, and is creating a generational divide too through asset price inflation, notably housing. The banking system is still under-regulated (shadow banking is hardly regulated at all) and the big tech companies are too dominant financially. World debt stands at 320% of GDP and risk is networked throughout the entire system. One tiny spark could ignite everything.

Where is this heading? A serious change of direction most probably. I think there’s a 50:50 chance of a global crash either next month (it’s generally October!) or spring 2020 and what will governments ,and the EU in particular, do in such a situation? They have no tools left to use, except, perhaps, for negative interest rates and taxation based upon wealth not just income and that would be explosive. You might create inflation to dilute the debt, but we’ve seen where that ends up.

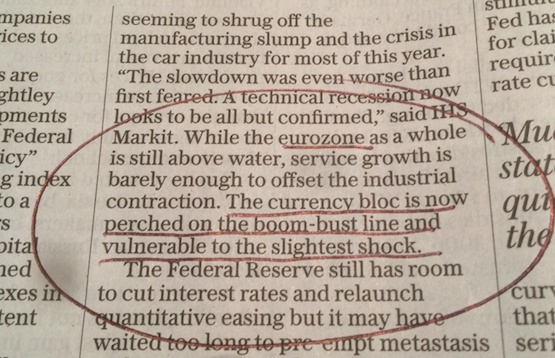

Wasting time at the hell hole known as Gatwick Airport and reading the New York Times. Not sure which is more of a worry, Donald Trump or the European Central Bank paying banks to take their loans (basically, you pay back less than you borrow, which is a bit like getting a free small car with a large car loan). I see trouble ahead! Also reading about the cooling off of prime real estate in New York and auctions that fail to sell things.

I’m almost certainly reading too much intro this, but the fact that six near identical Ferrari Testarossa’s from the late 1980s and early 1990s were on sale at Bonham’s auction in Paris last month may say something significant about the state of the global economy. The fact that half of them failed to sell may say something too. In short, the bubble seems to be reaching its peak and the top end of this and many other markets may be calming down, which might be a prelude to a crash. Weak signal? Quite possibly.

Given what’s going on in China I thought I’d share the edited version of the chapter on the economy while there’s a vague chance of me being prophetic. For those readers that are new to this I had huge problems with this chapter and it underwent several re-writes.

The older versions were posted here and here and here and here. (Runs from newer to older versions).

Final version is here (23 pages, PDF)

I spent yesterday with the MOD discussing what the world might look like in 2040. There were presentations on Sub-Saharan Africa and South and Central Asia along with an interesting discussion on the role of identity and how globalisation and the internet may be changing how individuals and groups see themselves. If anyone is interested there is a public domain document on some of the work to date that I can share.

Other thoughts…

Did anyone see Channel 4 News (UK) last night? There was a somewhat alarming piece on the emergence of a movement called Golden Dawn in Greece. Essentially, the economic downturn and austerity measures have released a surge of nationalism and racist violence. Even the police seem to be drawn into this by, in the first instance, questioning anyone that doesn’t look Greek and, in the second, locking up anyone that is in the country illegally. Tolerance, it seems, has gone out of the window.

This not only links with alienation and the rightwards shift of politics in Europe (especially the emergence of far-right parties), it also seems to have parallels with the 1930s and the second emergence of the KKK, which if my political memory serves me correctly, was fundamentally linked to austerity in the US.

Links: My blog post November 2011 about parallels with the 1930s

If you aren’t nervous enough already, here’s something else to worry about. In December 1929, at the time of the Great American stock market crash, America suddenly fell victim to a pandemic. The disease, called psittacosis, had been known about since 1892, but such was the state of that fear that gripped the nation in 1929 that it’s existence and threat was blown out of all proportion.

On 6 January 1930 a doctor that examined one of the first cases sent a telegram to the US Public Health Service in Washington DC that read; “Can you please supply parrot fever serum for our disposal immediately.” Further panic about contact with diseased birds then ensued. One US Admiral even ordered sailors to toss their pet parrots overboard, while the New York Times ran a front page that read: “Parrot Fever Kills 2 in this country.”

There were 169 confirmed cases of parrot fever in the US and 33 Americans eventually died. So was America in 1929 a dangerous place or just a gullible one? Parrot fever exists today in the US (and elsewhere) and infects between 100 and 200 Americans every year. The only difference is that over-exposure to social media is currently spreading economic anxiety rather than parrot fever.

Good conversation over dinner last night with a bunch of non-executive directors of ASX companies (hosted by PWC). Especially interesting was a discussion about Greece, the latest economic acronym PIGS* (Portugal, Italy, Greece & Spain) and where the debt contagion may go next (See House of Crads Blog entry below).

The worry, obviously, is that it’s all a house of cards. If Greece were to fall over, Portugal would probably topple next. Neither of these countries really matters because they are too small, but the ripple effect could move to Spain and then Italy and these are big economies.

We then had a brief discussion about wild cards and there were a few good lines flying around. One (which I also saw in the Wall Street Journal) was that “the biggest wildcard of them all is uncertainty itself.” Quite.

Apparently at one point I also said that “the secret of the future lies in the fringes of the present”. I can’t quite believe that I said this because it’s far too eloquent for me, but after a few glasses of nice wine I suppose anything is possible.

Another great debate was over peak oil and whether or not price rises are inevitable. If they are not, what are the wild cards? Collapsing global or Asian demand is obviously one, switch from oil to gas for transport is another and we also have new energy technologies of course.

One final thought on Europe by the way. When the EU put the Euro together did anyone build a scenario around a member nation going bankrupt? I remember that back in 2005 I built a set of scenarios for a bank, along with Ross Dawson and Oliver Freeman, and the EU falling apart was one of our wildcards – along with systematic financial system collapse!!!

One wildcard I think I’d add as of today is not Greece withdrawing from the Euro (almost impossible) but that Greece or some other member state pulls out of the EU in order to then extract themselves from the Euro. The betting is probably that if anyone were to do this it would be one of the PIGS, but I there is another scenario that came up last night. What if Germany just gets fed up with supporting these member states and Germany itself decides to pull out?

Now that’s the kind of wildcard I like — highly unlikely (almost impossible) but staggeringly impactful if it did ever happen. Makes your head spin.

* Sometimes it becomes PIIGS with Ireland added too.

I don’t usually read Newsweek, but I picked up a copy at the airport not so long ago. Their report on the scary new rich is one of the best things I’ve read in ages in the sense that I think they are totally on the money. Here, in brief, is what they said.

The middle class is often laughed at in Britain, but it has largely been the middle class that has driven development. They have been the moderators of extremism in politics and the brainpower behind much of the last century’s economic miracle. However, their day may soon be over. In ‘developed’ nations, especially in UK, the middle classes are about to get squeezed due to high levels of government debt (cue higher direct and indirect taxation), higher energy costs and rising food prices. In short, the rising standard of living that has been expected for more than a generation could be about to evaporate and families will find themselves considerably worse of than their parent’s generation. This is frightening enough but it’s not all that’s happening.

A new prosperous middle class is rapidly emerging in countries such as China, Russia, Brazil, India, Turkey and Indonesia. In 2009, 70 million new middle class people made an appearance on the world stage. According to Goldman Sachs they will be joined by roughly 2 billion others by the year 2050. These people buy stuff. The Chinese purchased more cars than Americans last year and in twenty years time people living in the so-called ‘emerging markets’ will own 90% of mobile phones. But what if the ‘emerging markets’ soon swap places with the ‘developed markets’ economically. What then?

It’s not just raw spending power that makes this trend interesting either. It has always been assumed that when nations like China or India develop they will adopt broadly western attitudes. Shanghai and Rio will end up looking much like London or Sydney. But what if they don’t? What if the new emerging middle class rejects liberalism, free markets and free speech? This is exactly what seems to be happening.

For example, the new Brazilian middle class approves of state intervention in the oil industry so as to keep foreign interest out of their country. Russia’s middle class (now 78% of the entire nation) is broadly supportive of Russia’s autocratic leader (the one pulling the strings, not the elected leader). This new middle class is broadly supportive of authoritarian government, state control and limits on free speech and elections just so long as the local economy keeps growing. This new middle class is individualistic and supportive of free trade and globalisation but is also nationalistic, protectionist and, in some instances, spoiling for a fight with the likes of the US. In short, millions of newly wealthy people around the world are rejecting the notion that you need political freedom for economic growth and are supportive of the idea that it doesn’t matter who runs the country, just so long as they keep in running it smoothly.

Meanwhile, the middle class in countries like the US is becoming suspicious of globalisation and is arguing that jobs that were once outsourced should be brought back home. As a result old antagonisms and special interests between nation states are starting to fray and a new world order is slowly taking shape, largely based around economic prosperity or the lack of it.

Of course there’s one area where the old and new middle classes converge. Both are anxious about the economy, interest rates, unemployment and global chaos. Both are also driven by a combination of pride and insecurity. Scary don’t you think?

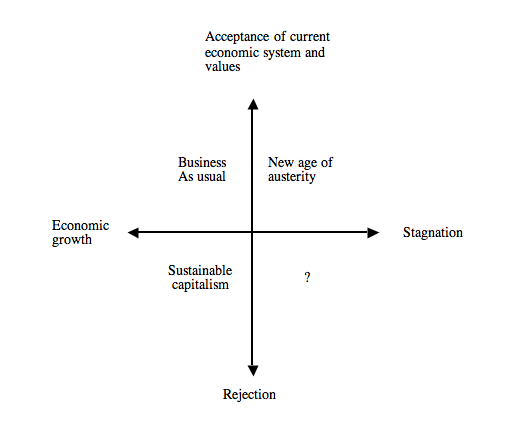

Here’s something that I scribbled on the back of a napkin on the plane from Hong Kong to Sydney. It’s a new set of scenarios for the economy. It’s really for the UK economy but could be adapted to the global economy.

I’m a bit stuck on a name for the last quadrant (bottom right). At the extreme it’s “Middle Class Revolution” but that’s not really it. ‘Personal Fortress’ perhaps?