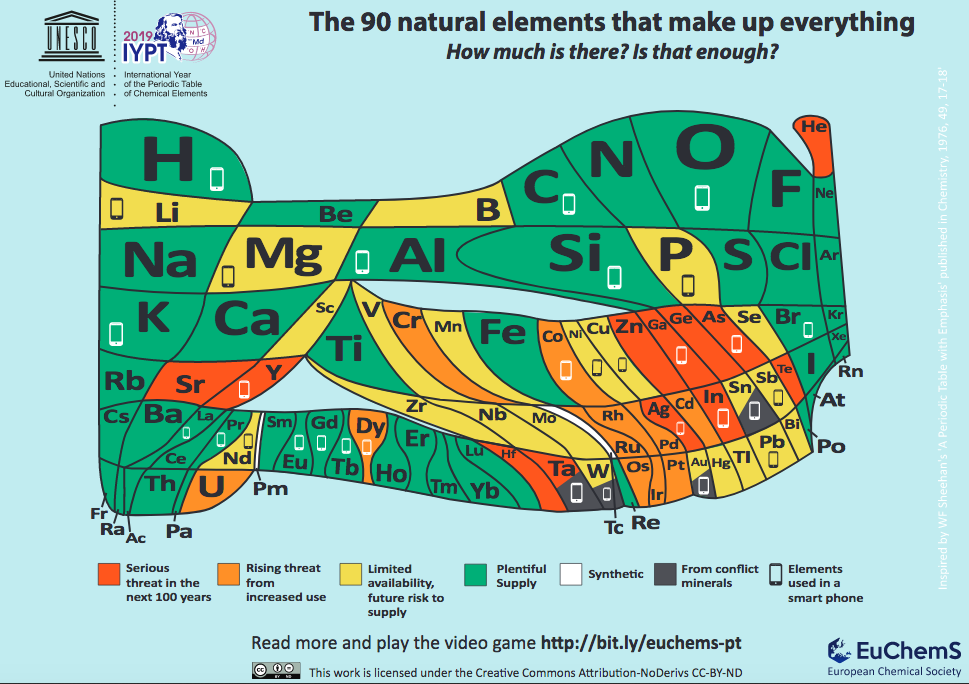

I vaguely remember seeing a different version of this, but huge thanks to Kevin for sending this one through. Not the best looking info graphic ever, but one of the more interesting. PDF here.

I vaguely remember seeing a different version of this, but huge thanks to Kevin for sending this one through. Not the best looking info graphic ever, but one of the more interesting. PDF here.

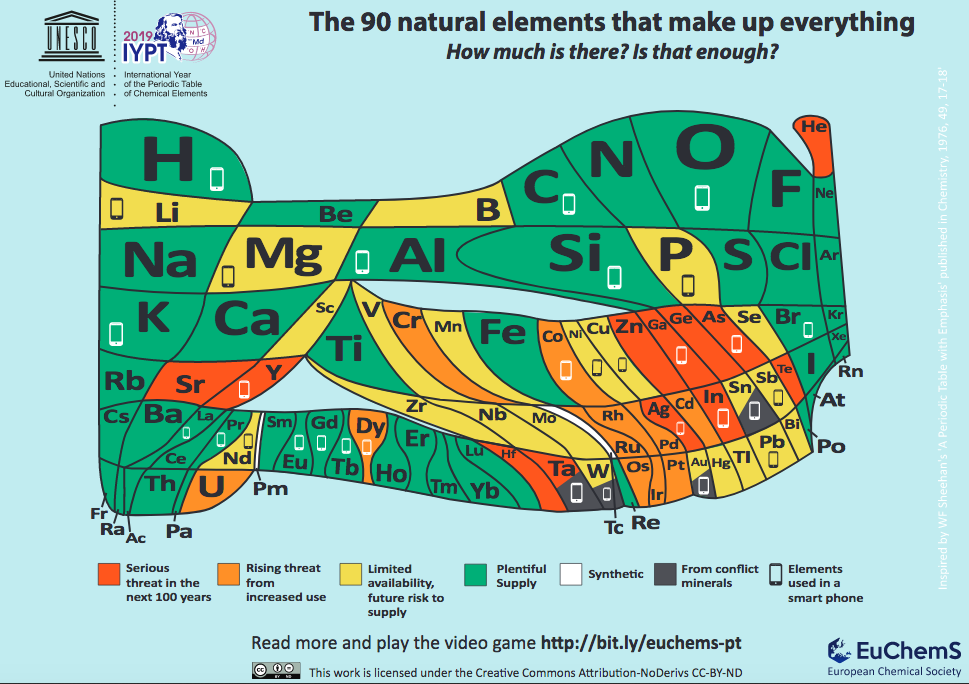

As seen in Edinburgh this morning. Is this anything to do with Brexit I wonder? I especially like the positiong next to the defribrillator!

It’s such a simple question. OK, it has overtones of those motivational speakers you get, especially in the US, and those dreadful motivational posters too, but it’s still a great question. It’s also a really hard one to answer. I was asked about best books and best films recently and these aren’t easy to answer either.

I’m inspired by nature. I love the ocean. I love deserts too. I’m especially enthused by the cosmos (which instantly makes me think of Carl Sagan). But down here on Earth? And individuals that are still alive? I think inspirational figures are few and far between and they seem to be getting rarer. OK, Charles Handy and Theodore Zeldin to kick things off.

All time? How about Einsten, Picasso, Hawking, Montaigne? Organisations? NASA without a doubt. The NHS. Other things? Education generally, Children generally, Museums (great buildings!), Great art, Human kindness, Florence Nightingale, Great questions, Flint hand axes…

Please add your own list….

Reasonable list here (but too many dead old men)

You put your first vote in

your second vote out

in, out, in, out

you shake it all about

You do the EU hokey cokey

and you turn around

that’s what Brexit’s all about

Woah, the hokey cokey

woah, the hokey cokey

woah, the hokey cokey

ears bent

patience stretched

ra-ra-ra

There is occasional wisdom in card shops….

Six of the best – something I wrote for the Sunday Mail in Australia.

1.Digital provenance

We’ve had provenance as an important trend in food and drink for some time and interest in where things are from and how they’re made is spilling over into areas like fashion too. A next step is digital provenance, whereby we become interested in how virtual products are made and what resources are used in their manufacture. An early example of this is Explainable AI, whereby the decision histories of automated systems can be revealed. This might sound geeky, but as we cede more control to machines it becomes increasingly important to establish whether computer code contains errors or biases. This is especially true when machines like autonomous vehicles make life or death decisions on our behalf.

A further development from this is what might be termed stories of creation, specifically, ‘extractivism’, which seeks to expose the natural resources used in the creation of everyday goods, especially virtual goods and services that we take for granted. This links with localism and sustainability, but also taps into a thirst for reassurance in the face of declining trust. Look out for growing awareness of the hidden costs of digital products and virtual services. (Did you now, for example, that the internet is now responsible for 15% of global energy use? – Data centres alone could use 20% of all available electricity by 2025).

2. Rise of the vegans.

Veganism, which, in case you have been asleep for the past few years, is the militant wing of vegetarianism, seeks to avoid the use or exploitation of animals and animal products in any form. This is claimed to be healthy for people and the planet too. At the extreme, activist groups such as Peta are seeking to shame or convert non-vegans, which perhaps taps into a growing level of ethical consciousness, especially among younger generations. There is currently a case before the courts in the UK to establish whether veganism can be considered a philosophy, in which case vegans will be conferred with certain rights. Indulgent self-identity or a sensible and sustainable solution to resource scarcity and climate change?

3. Digital balance

Digital transformation has been a mega-trend for some time, so it’s perhaps inevitable that a counter-trend would eventually emerge. Digital balance refers to people seeking to limit their use of digital products, especially mobile phones and social media. Evidence is starting to build that being overly connected can cause physical and mental harm and this is fuelling an interest in everything from analogue activities to pilgrimages where mobile devices are left behind in order to focus the mind on more important matters. At the extreme (there’s inevitably an extreme) some individuals, known as digital hermits, are rejecting digital technology altogether and are moving to remote places where such devices won’t work. Watch out for Tech-Free Tuesdays, schools banning mobiles and Wi-Fi networks, the growth of long-format journalism and, ironically, apps telling you when you’ve been online for too long.

4. Air quality

First it was carbon, then it was water, now the world’s global elite are worrying about air, and rightly so. Air quality, especially urban air quality in the world’s major cities is dreadful and in places like China and India it’s positively dangerous. But it’s not only outside that we have an invisible issue under our noses. Indoor air quality can be harmful too and it won’t be long before workers in places like Shanghai are sent home from work, not because the office or factory is too hot or too cold, but because the air quality inside is outside acceptable limits. Watch out for a growing demand for indoor air purifiers, air quality testing devices and Tasmania proudly proclaiming that it’s the fresh air capital of the world (queue fresh air migrants and fresh air tourism from the world’s most polluted mega-cities).

5. T.E.A

If you’re sitting on a beach in Asia or tucking into a backyard barbeque in the Southern hemisphere life probably seems pretty sunny. But in other parts of the world, especially northern Europe and the United States, dark clouds have appeared on the horizon.

T.E.A. stands for Tired, Emotional and Angry and describes the reaction of some people to everything from the BREXIT fiasco and the Teflon Trump trauma to the rise of authoritarian democracies and stagnating real incomes. Being T.E.A. results from being on the wrong side of globalisation, automation and digitalisation, where work is less secure and trust in experts and authority of all kinds has evaporated. The way to dilute T.E.A. is to seize back control from professional politicians and big business and provide a vision and most of all a narrative that makes sense to the vast majority of people. Keep Calm and carry on? More a case of “I’m mad as hell and I’m not going to take this anymore.”

6. Return of the human

It’s early days, but we are starting to see signs that people do, in fact, like having physical contact with other people at some level, especially when they largely live or work alone. Automated systems are all well and good in terms of convenience, but they often fail and the cost savings they produce are rarely passed onto end users. More crucially, digital has started to disappoint in that virtual interfaces can be sterile and lacking in human warmth.

The Rise of the Human is distantly related to the Big Tech backlash, which taps into the tax-shy and ethically ambiguous behaviour of the FANGs (Facebook, Amazon, Netflix, Google), but has more to do with the fact that many of the products we now rely on have been invented by nerdy and emotional stunted young men who have little or no understanding of real human needs. Keep an eye open for products that celebrate the human element, slogans, t-shirts and labels saying ‘Human Made’ and companies otherwise celebrating human uniqueness and imperfection. Also, watch out for the rise of craft, a celebration of ancient cultures and companies re-introducing people to replace machines. What goes around comes around as they say.