So, the future of banking. Or is it the future of banks? This is the question.

Either way, it’s always dangerous to suggest a singular future, because in my experience events have a nasty habit of tripping up even the best laid plans and predictions. I prefer scenarios as a way of hedging strategy. Case in point is Greece. Back in early 2007 I wrote a blog post about the end of physical money. It was partly based upon my experience of going to the small Greek island of Hydra with pocket full of Euros only to find that nobody wanted them. It was essentially a cashless economy with one ATM that hardly anyone used.

But I returned to Hydra a year later, in 2008, and the situation had reversed. All anyone wanted was cash and the single ATM on the island had a permanent queue beside it. Why?

The reason was the GFC. Trust had evaporated from the island economy.

For me, this illustrates how the future is scenario dependent and how making big bets on any one future needs to be considered carefully. A variety of non-technological factors also need to be taken into account, ranging from the health of the economy, to regulation and most of all people – all of which, especially people, can and do change direction.

Bill Gates once observed that banking is essential, but banks are not. Or as I observed in my book Future Files eleven years ago, if everyone from supermarkets to car companies is offering financial services, where does that leave the banks? I think we’re still trying to figure this out in 2018.

The most likely future for banks is that some become platforms while others become pipes.

The platform future is highly credible, partly because people tend to trust banks with their money, especially large amounts of it, more than non-financial organisations. But again, this is scenario dependent. If the economy is strong, and people feel confident about the future, I think they’ll consider all kinds of things including peer-to-peer lending and cryptocurrencies, but if the economy tanks I think people will stay with whom and what they know best.

This could all change, of course, due to the behaviour of banks or due to security concerns or cost, but history suggests that getting people to move from one bank to another or to something else entirely isn’t easy.

In the UK, people worried that when the supermarkets offered loans and insurance this would upturn the banking industry, largely because the supermarkets had footfall, loyalty and perhaps cost on their side, but it didn’t happen. This is the main reason I’m somewhat sceptical about Open Banking.

I’ve got several bank accounts, but I’ve had my main account with RBS for 35 years. They aren’t especially good. I’m earning no interest and their branches look like care homes. But I just can’t be bothered to move, because all banks feel more or less the same to me.

You could argue that Pay Pal is a bank – one with 227 million accounts – that’s upturned the banking industry. But then Pay pal piggybacked e-Bay and was almost the only credible online payments company at the time. I have little doubt that Facebook, Apple and Amazon will all upturn payments, but the question is can they – or Pay Pal – move beyond this?

They might if banks can’t get can’t get their existing systems right.

Why wife has a number of bank accounts too, including one with an Australian bank and I don’t think that she has ever experienced worse systems anywhere. Why is this so hard? I asked her for some comments and she said, and I quote: “They’ve got such an attitude, like I’m an inconvenience to them.” “My requests are ignored” “They send me things meant for other people” “They have no understanding of customer service” “They think they’re a global bank, but they act like a post office in rural Queensland.”

So, don’t think that building a platform is some kind of Shangri-La. Job done and all that. It has to work really well. And, of course, you will compete with other organisations, especially the big global tech firms, that are seeking to become platforms too. Many, like Facebook, Apple and Amazon already are.

Will such platforms mean the end of bricks and motor banking? Not in my view.

There is clearly a market for born digital banks, as there’s a market for smaller challenger banks, but I’m not sure how big either market could get or whether digital-only banks can create real margins.

In my view, Omni-channel is the future, although we don’t yet have a clear view of the balance between the physical and the virtual. We’re still trying to work this out, not only in banking, but in other areas too ranging from retail to office space.

What we are seeing, rather interestingly, is the likes of Amazon opening physical stores. I’m not sure these will last, but it strikes me that if you are seeking to attract new customers or migrate customers into higher value products – or perhaps sell experiences rather than products – then it appears that the physical still has its uses.

But back to platform banking.

In my view, any platform needs to demonstrate total security and I’m cynical about this. I’ve been cyber attacked more times than I can remember, including once via an Australian bank years ago and once via Uber a month ago.

Digital trust is the #1 issue going forward in my view.

Sure, Apple Bank sounds sexy, but I don’t especially trust Apple, Amazon, Facebook – or God forbid Uber – with anything these days.

This may change. The technology will improve. So too, I hope, will the governance and ethics surrounding some of the Big Tech firms.

The good news is that the technology is about to get better, especially in the area of compliance automation and fraud detection.

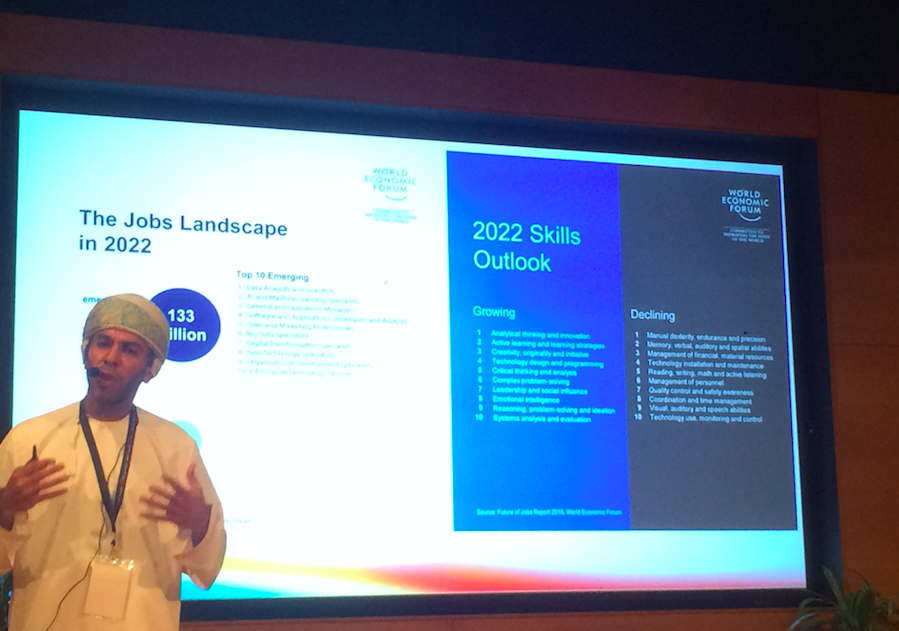

AI, advanced machine learning and predictive analytics also offer a myriad of other opportunities going forward.

In a smart future, money becomes intelligent. For example, my money will know where it is and whether it should be somewhere else. My money will have the ability to move itself around, either with or without my direct control, seeking better investment opportunities or responding in real time to current needs.

My money will know what I’m buying and when I’m likely to need to buy something else.

Tax will become real time. No more annual tax returns, instead annual tax is removed at point of purchase, as it is already with GST or VAT. With smart tax paid in real time governments could vary the tax according to observed spending patterns. So, for example, the tax on one packet of cigarettes might be 50%, but if I try to but more than one packet within a week the tax rises to 90%.

Insurance would become predictive and individually tailored too. It could be sold by the minute based upon real time data and intelligence about local risks.

Money, and especially credit and debit cards, become programmable in a smart future. Parents can limit where and when their children spend their money. So, yes to Rip Curl on Campbell Parade on Saturday, but no to Haigh’s chocolates in the Strand Arcade on Monday. This principle of control especially applies to online spending. Lenders could also personalise interest rates in a smart future.

And if money is smart it can be programmed to achieve social goals. This is a very old idea. Sumptuary taxation it was called it back in Roman times. Taken to the limit, this could mean that currencies collect their own data and apply rules for how they are spent. This is where crypto currencies and smart ledgers may be heading. So, for example, in the future you may not be able to use Bitcoin in KFC. Not because KFC doesn’t accept Bitcoin, but because the Bitcoin community doesn’t accept KFC.

A truly intelligent platform would allow me to talk to my money. I could talk to my money about whether to shift investment funds away from the resources sector and ask for evidence about whether or not I should do so. I could ask for various options to be modelled financially or ask for help that will improve any important life decision.

My money will be able to argue with me and I’ll be able to track the reliability of its advice. Or maybe my lifetime personal AI-powrered avatar will interact directly with my the platform (aka my money) and then come to me personally with it’s own recommendations. Anyone trying to sell me anything in the future will, similarly, have to ask their ‘bot to talk to my ‘bot and my ‘bot will recommend certain actions.

My money should be able to advise me on whether I buy airline tickets this week or next. Should I switch my utility supplier? Should I buy or rent an apartment? Should I allow a third party to look at my data? This is a self-driving bank account. It’s my own personal CFO. This is a truly customer centric bank with a lifelong 360-degree view of me.

One thing I’ve been keen on for a while, BTW, is the merger between wealth and health – healthcare and wealthcare. If a platform not only has transactional data, but data about my genetics, my family history and my daily lifestyle, including eating and sleeping patterns, it can make fairly accurate predictions about how and when I’ll get sick in the future. If I know this I can the act to stop certain futures from occurring. I can, for example, save up for medical procedures that I’ll need 20 or 30 years hence. It could even advise me on wealth de-accumulation, based upon my predicted year of death.

This links very strongly with one of the biggest trends that’s out there, which is ageing.

In this future, the platform looks after more than my money. It looks after me in the most general sense and perhaps looks after my extended family too. In an extreme case, my money might even decide that I cannot be trusted with my own money and will take control of it away until I can demonstrate financial responsibility.

But why should advice be limited to financial services or even healthcare?

Why can’t my bank advise me on university courses, career changes, holiday plans…anything? To some extent this is precisely what banks used to be before they got caught up with financial innovations that nobody outside banking understood.

Back in the day local bankers were among the most trusted members of any community. You’d even discuss a marriage proposal with your local bank manager.

Maybe we can go back to this, but only if we can align a few things, some of which banks control and some of which they don’t.

First, we need total security. Without total digital security, you cannot have digital trust and without trust nothing works. This is the battleground. If there’s an ongoing issue with cyber security the platform idea won’t work. Neither will anything else. As AI becomes more sophisticated, I expect it to become more challenging to maintain security.

And don’t forget that Quantum computing is possibly only ten years away and unless you can create Quantum safe cryptography everything, and I mean everything, could fall apart (Cryptocurrencies and Block-chain are not exempt.)

Two, you need strike a balance between collecting enough data to provide really useful personalisation and predictive analytics, but not so much that you freak people out. Privacy isn’t dead and personally I think it’s importance will grow in the future. If you abuse either privacy or trust then loyalty evaporates. Without trust and loyalty there’s no data.

Three, data ownership. We need to agree whose data this is. Is it mine, is it yours, is it shared or does it belong to someone else? Personally, I believe that if my actions create data then it’s my data – and I should be paid for it or at the very least have an open and fair discussion about what I will receive if I surrender it.

It’s not inconceivable that people will opt out of surrendering their data if security and privacy are not maintained. This is a huge issue, because value added services are data driven. You cannot move from payments into wealth without data.

A fourth and final challenge is complexity. You need to unravel complexity. You need to respond to too much information and too much choice. Simplify.

BTW, and I’m sure this is obvious, in my view there’s a very big risk attached to platforms, which is that in the rush to build a platform you could neglect payments, and if you significantly lose payments you potentially lose the gateway to everything else.

Another risk worth thinking about is that in the rush to provide services for a new generation of account holders via apps and mobile tools, there’s a very real danger that you could ignore your existing, ageing customer base. It is a bank’s obligation to maintain existing services for an ageing population, an ageing population which, from memory, holds around 80% of global wealth and is technology shy in many instances.

And while I’m on the subject of unravelling complexity, I think there’s another huge opportunity with the cohort under the Millennials, under Gen Z in fact.

Government and schools are doing a truly terrible job of educating our children about money. Isn’t this something banks should be doing more of? And what of the poor?

Could you be helping them in better ways too?

Anyway, that’s one future. The platform, via a rather scenic route.

How about the pipe?

Some banks will decide to become pipes, other will become pipes by default.

What do I mean by a pipe? Simply that some retail banks will most likely become disintermediated and become white label or commodity suppliers. They will facilitate payments on behalf of other organisations higher up the financial food chain.

Given enough volume this isn’t a wholly unreasonable business to be in, but it’s probably not especially profitable and probably won’t attract much talent or investment. It can also hard to build relationships in a purely digital sphere in my opinion.

The bad news is that this is happening already. Mono-lines are already taking away higher value mortgage and investment business leaving some of the banks shifting ever smaller amounts of money from one place to another.

BTW, when I was thinking about all this one strange thought popped into my head.

Most people join a bank – but you don’t join Coles do you? Why? I’m not sure, but it might be historical. It may have something to do with the fact that credit unions and building societies, in particular, were movements that you joined. Worth thinking about, perhaps.

Anyway, why can’t banks become both a platform and a pipe and then grow the thing customers need more than anything else, which is reliable advice?

Why can’t a bank offer services online, through mobile, internet or platform banking, but alongside this have a physical street presence that offers advice, problem resolution or facilitation for specialist loans? You do this already, of course.

But I’m not talking about a handful of branches filled with a few leaflets. The idea I’d like to propose is a highly personalised online presence backed up by physical branches built like they used to be – cathedrals of security and social status where personal bankers develop a full 360-degree view of customers and their lifetime purchasing needs using AI tools and non-siloed databases.

Transactional services are the entry level tickets to this game. Then you need to migrate customers up the ladder to wealth, health and specialist spending. For example, why do all bank branches look more or less the same? I know there are branches for business customers, kiosk branches, flagship branches and ATM networks, but why can’t branches be built that tap into the needs of communities of interest?

What do I mean by communities of interest? I mean tribes. Petrol heads, book lovers, cooks, home renovators, travellers, fitness freaks. Build one stop shops around specialist spending or loan areas and hire staff that are passionately interested in these same areas. In other words, speak to customers about what they are passionately interested in, which by the way isn’t banks.

Why, for example, can I walk into any bank branch and pick up a leaflet for a car loan, but can’t walk into a single one where there’s a car for sale and someone that loves cars. If car dealers are offering loans why can’t banks offer cars? But there’s more to this that just loans. The bank ought to be my car advisor.

BTW, are we not talking about retail banking here? Why are banks so embarrassed about having shops? Why are retail bankers so embarrassed about being retailers? Why not aim to become the best retailer on the planet? Why not be a retailer than uses technology to highlight the enduring importance of physical engagement and human interaction.

To end, two questions:

1. What are banks for? What could they be for in the future?

2. If everyone is becoming a bank, what should banks become?