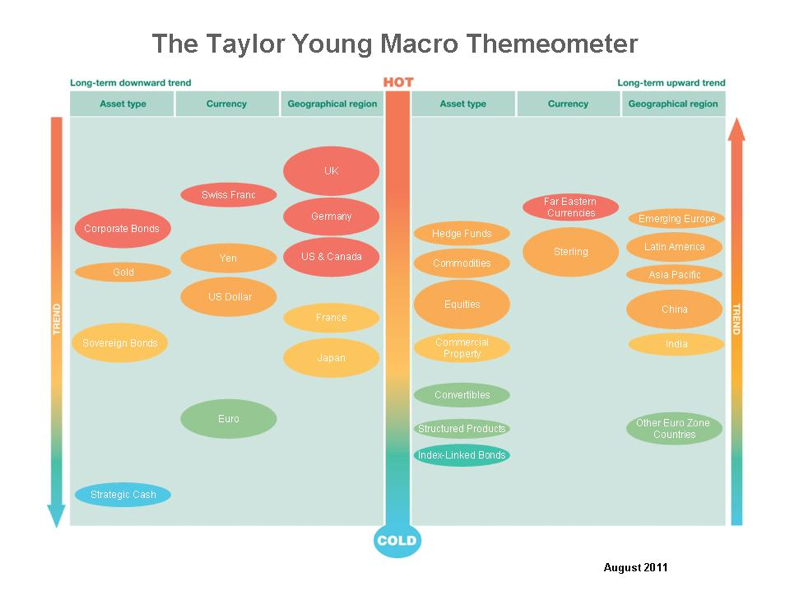

I rather like this. It’s from Taylor Young and is a model of what’s hot and what’s not. If you are not familiar with thematic investment this is a way of using certain emerging social, demographic, economic and technological trends etc to imform investment strategies. If you look at some of the broad themes I write about you should immediately notice a number of these themes ranging from ageing and resource scarcity to mobile connectivity. (See this blog, What’s Next, my trend maps or Future Files for more on this).

So, for example, if you buy into the ageing trend (and it’s hard not to) this immediately throws up some investment opportunities ranging from healthcare and food to retail and travel. Mix in another trend such as connectivity and you have a potential sweet spot of remote monitoring technology that enhances quality of life, reduces healthcare costs or allows people to live at home for longer.

Of course, the problem is not so much recognising particular themes, but in working out which companies in a particular sector or industry will be the winners over a long period. It wouldn’t take a genius to highlight clean energy, for example, but which of the thousands of companies, big and small, that are involved in this area will come out on top in the longer term?

BTW, this is general information and in no way represents any specific investment recommendation or advice as my lawyer friends would say.