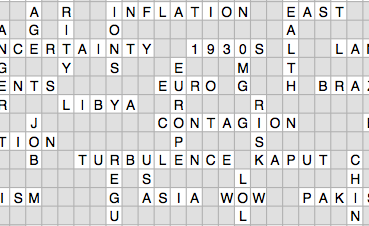

Here’s a link to the PDF of my 2012 map. Regarding Europe, which features heavily towards the centre of the map, I had an interesting chat with Anthony Hilton from the Evening Standard the other night about the European situation. He made the very good point that the EU is targeting the wrong problem.

The issue isn’t European solvency, it’s European competitiveness (or the lack of it), especially in southern Europe. That’s why there’s a problem with debt.

Also a good piece in the Telegraph this morning about QE (i.e. printing money). This, too, was on the money in the sense of highlighting how the UK government is playing with fire by digitally printing money to buy it’s own debt. You heard that right. It’s buying its own debt – to the tune of £50 billion (on top of the £275 billion it has already bought). Had the government actually printed real money and we saw truckloads of it being shifting around the city there would, no doubt, be an outcry. But it’s digital so there’s nothing to see.

What happens if you buy your own debt? In the short term a transfer from savers to debtors – so thrifty pensioners will be hit hard while profligate borrowers (who partly caused this mess!) will have access to further funds. Doesn’t seem right really. We are allocating vast amounts of money to individuals and institutions that speculate, or transfer money from one place to another, rather than putting it in the hands of people that actually invest in wealth creation and jobs.

As to longer-term impacts, who knows? This is part of the largest money printing experiment in modern history.