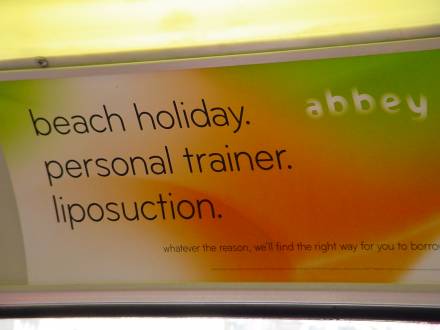

The level of credit card debt in Britain has increased by 73% since 1997. The UK now holds 60% of all credit cards issued in Europe and has 75% of all European credit card debt. Spending on credit cards now represents 11% of GDP and 40% of people say they expect to use their cards more with the advent of new technology. Meanwhile, the amount owed to credit card companies in the UK now stands at GBP £53 billion. Figures for other countries such as the US and Australia are following a broadly similar trend. So what happens if (when) interest rates really go up? Trouble, that’s what.

The level of credit card debt in Britain has increased by 73% since 1997. The UK now holds 60% of all credit cards issued in Europe and has 75% of all European credit card debt. Spending on credit cards now represents 11% of GDP and 40% of people say they expect to use their cards more with the advent of new technology. Meanwhile, the amount owed to credit card companies in the UK now stands at GBP £53 billion. Figures for other countries such as the US and Australia are following a broadly similar trend. So what happens if (when) interest rates really go up? Trouble, that’s what.

What's Next: Top Trends

Diary of an accidental futurist – observations on current & future trends