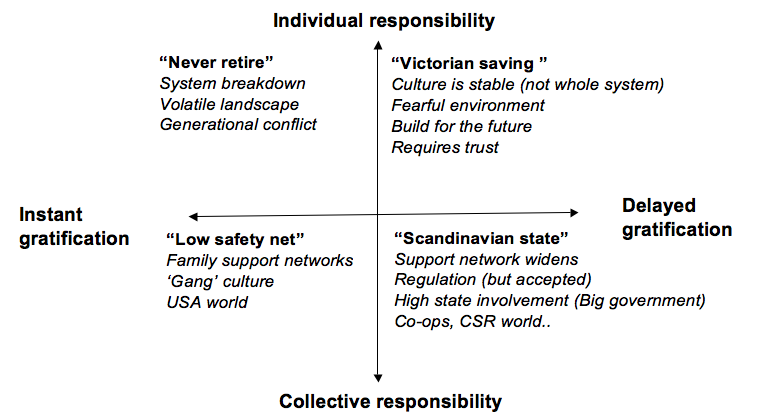

Here’s the pensions scenario set. It was broadly agreed that the state will move away from pensions provision and so will employers – which leaves things firmly at the feet of individuals, most of whom seem to ignore the issue until it’s too late. Delayed gratification is obviously saving and instant gratification is obviously spending. Lots wrong with this but it did create an interesting conversation. Takeaways? Key one is the importance of seeing the difference between a driver of change and a consequence. Another takeaway is the critical role of assumptions.

What assumptions have been made here? One assumption could be that societal ageing and a declining birthrate are fixed trends. What if they aren’t? What if people start dying really young again due to diet/lack of exercise or people suddenly decide to have lots of children again (to care for them in their old age)?

Another assumption might be that people are saving right now but not in ways that pensions experts recognise as saving.

Richard can you tell me more about the future of pensions in the UK?

I just posted quite a long response and it’s disappeared! Will email you….

richard could you please send to me as well ?

What’s in the post is pretty much where we got to. In terms of other thought I’m up to my eyes with 2 book deadlines of March 31 so can’t really get into this now. How about a dinner in London sometime to discuss the future of pensions from a scenario POV?