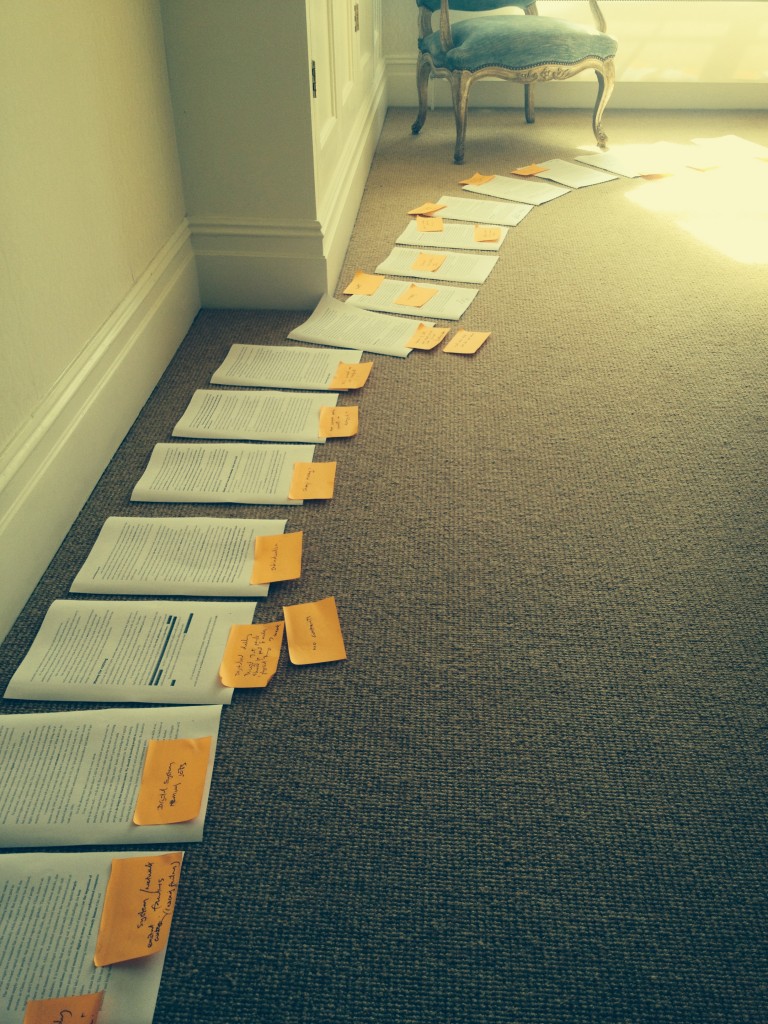

A few readers have expressed an interest in seeing the before and after of chapter 4, the money chapter, so here it is. As I mentioned a few days ago, this has always been the problematic chapter, partly because it was originally the opening chapter and was written well before we agreed on the title Digital vs. Human. The first issue I have is flow, which is easy to solve, and there are some logical jumps too, which, again, are fairly easy to fix.

To some extent I’ve dug myself into a hole with the shark tale, which I love, and this might have to go. It’s a great example of income and wealth polaristion, but I do wonder what it has to do with digital. Otherwise it’s simply a case of glueing it all together and linking strongly to either digital or human. I also need to bring out more on network effects, systemic risks (network decay?), Peer-to-Peer lending and borrowing, alternative currencies, micro-payments, NFC, Apple Pay and Google Pay, and most of all the differences between physical and digital cash (not sure f there’s a difference between physical and digital debt but it’s worth a look). Also, potentally, QE, which I thought I understood really well until I started to write about it.

Once I have the ‘after’ of this chapter I’ll post it, although I might post a few ‘in progress’ updates or even ask you what you think about certain passages or problems.

Chapter 4: Money and Economy (original uncorrected version)

“The idea of the future being different from the present is so repugnant to our conventional modes of thought and behaviour that we, most of us, offer a great resistance to acting on its practice.”

John Maynard Keynes

A few years ago I was walking down a street in central London when a white van glided to a halt opposite. Four men stepped out and slowly slid what looked like a giant glass coffin from the rear. Inside it was a large live shark.The sight of a shark in central London was slightly surreal, so I sauntered over to ask what was going on. It transpired that the creature in question was being installed in a giant underground aquarium in the basement of a house in Notting Hill. This secret subterranean lair should, I suppose, have belonged to Dr Evil. To local residents opposing deep basement developments it probably did.

A more likely candidate might have been someone benefiting from the digital and globally networked nature of finance. A partner at Goldman Sachs, perhaps.This is the investment bank immortalised by Rolling Stone magazine as: ‘a great vampire squid wrapped around the face of humanity.’ Or possibly the owner was the trader known as the London Whale, who lost close to six billion dollars in 2012 for his employer, JP Morgan, by electronically betting on a series of highly risky and somewhat shady derivatives known as Credit Default Swaps.

Whichever ruthless predator the house belonged to, something fishy was underfoot. My suspicion was that it had to do with how the digital revolution was opening up a chasm between a skilled and wealthy elite and the rest of society. This, in turn, is linked to a shift of power away from locally organised labour to globally organised capital, the morals of which can warp the foundations of reality. This is especially true when capital takes little or no responsibility for the holes that others fall into.

Throughout most of modern history, around two-thirds of the money made in developed countries was typically paid as wages. The remaining third was paid as interest, dividends or other forms of rent to the owners of capital. But since 2000, the amount paid to capital has increased substantially while that paid to labour has declined, meaning that real wages have remained flat or fallen for large numbers of people.

The shift toward capital could have an innocent explanation. China, home to an abundant supply of cheap people, has pushed wages down globally. This situation could reverse, as China runs out of labour to move to the cities, their pool of labour shrinks, due to ageing, and Chinese wages increase. Alternatively, low-cost labour may simply shift somewhere else — possibly Africa. But another explanation for the weakened position of labour is that humans are no longer competing against each other, but against increasingly sophisticated machines. It is humans that are losing out. A future challenge, for both governments and firms globally, will be the allocation of resources between people and machines given that machines will take on an increasing number of roles and responsibilities.

Ever since the invention of the wheel we’ve used machines to supplement our natural abilities. This has always displaced certain skills. And for every increase in productivity and living standards there’ve been downsides. Fire cooks our food and keeps us warm, but it can burn down our houses and fuel our enemy’s weapons. During the first industrial revolution machines further enhanced human muscle and we then outsourced other more difficult and dangerous jobs to machines. More recently we’ve used them to supplement our thinking by using machines for tedious or repetitive tasks.

What’s different now is that information technologies, ranging from advanced robotics and personal computing to analytics and autonomous vehicles, are threatening areas where human activity was previously thought essential or unassailable. In particular, software and algorithms with near-zero marginal cost are now being used for higher-order cognitive tasks. This is not technology being used alongside people, but instead of them. Losing an unskilled job to an expensive machine is one thing, but if highly skilled jobs are lost to cheap software where does that leave us? What skills do the majority of people have left to sell if machines and systems start to think?

I remember ten or so years ago reading that if you index the cost of robots to humans with 1990 as the base (1990=100) the cost of robots had fallen from 100 to 18.5. In contrast, the cost of people had risen to 151. Der Spiegel, a German magazine, recently reported that the cost of factory automation relative to human labour had fallen by 50 per cent since 1990.

Over the shorter term there’s not much to worry about.Even over the longer term there’ll still be jobs that idiot savant software won’t be able to do very well — or do at all. But unless we wake up to the fact that we’re training people to compete head on with machine intelligence there’s going to be trouble eventually. This is because we are filling peoples’ heads with knowledge that’s applied according to sets of rules, which is exactly what computers do. We should be teaching people to constantly ask questions, find fluid problems, think creatively and act empathetically. We should be teaching high abstract reasoning, lateral thinking and interpersonal skills. If we don’t a robot may one day come along with the same cognitive skills as us, but costs just $999. That’s not $999 a month, that’s $999 in total. Forever. No holidays or sick pay either. How would you compete with that? If you think that’s far fetched, Foxconn, a Chinese electronics assembly company, is designing a factory in Chengdu that’s totally automated — no human workers involved whatsoever. I’m fairly sure we’ll eventually have factories and machines that can replicate themselves too. It’s funny that our addiction to machines, especially mobile devices, is undermining our interpersonal skills and eroding abstract reasoning skills and creativity, when these skills are exactly what we’ll need to compete against these machines.

But who ever said that the future couldn’t be deeply ironic.

One optimistic outcome is that the productivity gains created by new technologies will eventually show up and the resulting wealth will be fairly shared through progressive taxation. Perhaps there’ll be huge cost savings made in healthcare or education. Technologically induced productivity gains may offset ageing populations and shrinking workforces too. But if the rewards are not equitable then a bleaker future may emerge, one characterised by polarisation, alienation and discomfort.

The pursuit of more

Tim Cook, the CEO of Apple, recently responded to demands that Apple raise its return to shareholders by saying that his aim was not to make more profit. His aim was to make better products, from which greater financial returns would flow. This makes perfect sense to anyone except speculators seeking short-term gains at the expense of sustainability or resilience.

It was Plato who pointed out that an appetite for more can be directly linked with bad behaviour. This led Aristotle to draw a black and white distinction between the making of things and the making of money. Plato would no doubt have been rather disillusioned with high frequency trading. In 2013, algorithms traded $28 million worth of shares in 15 milliseconds after Reuters released manufacturing data milliseconds early.

Doubtless money was made here, but for doing what? It’s a similar story with sub-prime mortgages, which digitalisation helped to create and spread at astonishing speed until the market imploded.

Historically, various religions have voiced concerns about the pursuit of money and psychologists have linked thinking too much about money to cheating and non-virtuous behaviour. Danny Dorling, a Professor of human geography at Oxford University, quotes research saying that in unequal societies individuals tend to be less healthy, worse educated and less happy, with the most unequal societies tending to be the most dysfunctional. We already have a situation where education and incomes tend to reinforce each other. Health can be linked with both too. So how long before society is riven in two with a healthy, highly educated, high earning elite living to 150 years and the rest — poorly educated, malnourished and sporadically employed — living to half that. Is this acceptable? Will people revolt?

Large basement developments such as the one I stumbled into represent more than additional living space. They are symbolic of a gap that’s opened up between wealthy individuals who believe that they can do anything they want if they can afford it and others who are attempting to hang on to some semblance of shared community. A wealthy few even take pleasure seeing how many local residents they can upset, as though it were some kind of glorious game. Of course, in the midst of endless downward drilling and horizontal hammering, the many have one thing that the few will never have, which is enough.

Across central London, where a large house can easily cost ten million pounds, it is not unusual for basement developments to include underground car parks, gyms, swimming pools and staff quarters, although the latter are technically illegal. It’s fine to stick one of the world’s most evolved killing machines 50 feet underground, but local councils draw a line in the sand with Philippino nannies.

The argument for downward development is centred on the primacy of the individual in modern society. It’s their money and they should be allowed to do whatever they like with it. There isn’t even a need to apologise to neighbours about the extended noise, dirt and inconvenience. The argument against such developments is that it’s everyone else’s sanity and that neighbourhoods and social cohesion rely on shared interests and some level of civility and cooperation. If people start to build private cinemas in basements or knock down adjacent homes to build private gyms this means they aren’t frequenting public spaces such as local cinemas and local gyms, which in turn impacts on the vitality of the area. In other words, an absence of reasonable restraint and humility by a handful of individuals significantly limits the choices enjoyed by the broader community.

In ancient Rome there was a law called Lex Sumptuaria that restrained public displays of wealth and curbed the purchasing of luxury goods. Similar sumptuary laws aimed at superficiality and excess have existed in ancient Greece, China, Japan and Britain. Perhaps it’s time to bring these laws back — or at least to levy different rates of tax on immodest or socially divisive consumption.

However, there’s a bigger problem than large basements. It’s been estimated that across Europe there are 11 million empty homes, including 700,000 in the UK, some of which are multi-million pound mansions. That’s enough empty space to house Europe’s homeless twice over. This is an interesting number to play with, especially if you throw in the fact that, according to the charity Oxfam, the world’s 85 richest individuals own as much as the poorest 3.5 billion.

Income polarisation and inequality aren’t new. Emile Zola, the French writer, referred to rivers of money: ‘Corrupting everyone in a fever of speculation’ in mid-19th Century Paris. The writer John Ralston Saul refers to 19th Century moneymen as: ‘marginal, irresponsible, parasites living off the flesh of real capitalism…their relationship to other citizens was roughly that of the mafia today…and yet we now treat them as if they were pillars our society — both socially and economically.’But the visibility and concentration of lavish spending and consumption in city-states like London, alongside stagnant wages for the majority, is bound to have consequences.

The rapid ascent of wealth in London is partly due to the effects of technology and partly due to unchecked financial liberalisation. It’s also due to London property being a safe place to stash money at a 10 per cent growth rate and, in the words of William Gibson, the former sci-fi writer, because it’s: ‘Where you go if you successfully rip off your third world nation.’ Not that the nation necessarily has to be third world.

What’s especially worrying here, although it may apply everywhere, is that studies suggest that wealth beyond a certain level erodes empathy, which may mean that elites shift toward more conservative positions to guard what they’ve got.

Some good news for a change

But it’s not all bad news. Globally, the level of inequality between nations is lessening and so is extreme poverty. In 1990, 43 per cent of people in emerging markets lived in extreme poverty, defined as existing on less than $1 per day. By 2010, this figure had shrunk to 21 per cent. By accident or design (or maybe inflation) global poverty has been reduced by half in 20 years. Nevertheless, the gap between the highest and lowest earning members of society is growing rapidly and is set to continue with the onward march of digitalisation, networks and automation. If you have a skill that the world wants it’s possible to make an awful lot of money very quickly nowadays. Whether or not such wealth is temporary or illusory remains to be seen, but the spoils of regulatory and technological change have largely been accrued by people who are highly educated and internationally minded.

If you don’t have the right skills, or you can’t adapt quickly enough, you can become poor equally fast and may remain so indefinitely. This can be contested. In Europe, the amount of wealth held by the elite is far less than it was in the 19th Century. However, since 1970 the trend has indeed been in the opposite direction and the concentration is increasing.

In the UK, since 1980, the percentage of total income going to the top 1 per cent of earners has almost doubled reversing a 30-year trend. This can perhaps be ignored if everyone is thriving, but when lots of people aren’t, this tends to stick out.

Take another number. 25 years ago, London was home to 9 billionaires. Now it’s home to 84. This trend towards wealth concentration is noticeable elsewhere in the world too.

In his book Capital in the Twenty-First Century, Thomas Piketty points out that the Wimbledon tennis championships are now broadcast to more than 200 countries and the prize money in 2014 topped £25 million. Back in 1974 the prize money was £91,000. That’s roughly a thirty-three-fold wage increase, taking into account cost of living increases. Over the same period, hourly earnings in manufacturing rose by a factor of two. You can digitalise tennis via global media, but digitalising childcare or bricklaying is more difficult, although perhaps not impossible.

In theory the internet should be creating jobs. In the US between 1996 and 2005 it looked like it might. Productivity increased by around 3 per cent and unemployment fell. But by 2005 (i.e. before the global recession) this started to reverse. Why might this be so? According to McKinsey & Company, a firm of consultants, computers and related electronics, information industries and manufacturing contributed about 50 per cent of US productivity increases since 2000 ‘but reduced (US) employment by 4,500,000 jobs.’

Perhaps productivity gains will take time to come. This is a common claim of techno-optimists and the authors of the book, Race Against the Machine. Looking at the first industrial revolution, especially the upheavals brought about by the great inventions of the Victorian era, they could have a point. But it could also be that new technology, for all its power, can’t compete with simple demographics and sovereign debt.

Perhaps, for all its glitz, computing just isn’t as transformative as stream power, railroads, electricity, the telegraph or the automobile. Yes we’ve got Facebook, Snapchat and Rich Cats of Instagram, but we haven’t set foot on the moon since 1969. It is certainly difficult to argue against aspects of technological change. Between 1988 and 2003, for example, the effectiveness of computers increased a staggering 43,000,000-fold. Exponentials of this nature must be creating tectonic shifts somewhere.

In it’s heyday, in 1955, General Motors employed 600,000 people. Today, Google, a similarly American iconic company, employs around 50,000. Facebook employs about 6,000. More dramatically, when Facebook bought Instagram for $1 billion in 2012, Instagram had 30,000,000 users, but employed just 13 people full time. At the time of writing, Whatsapp had just 55 employees, but a market value exceeding that of the entire Sony Corporation. (have these examples now been overused?). This forced Robert Reich, a former US treasury Secretary, to describe Whatsapp as: ‘everything that’s wrong with the US economy.’ This isn’t because the company is bad — it’s because it doesn’t create jobs. These are examples of the dematerialisation of the global economy, where we don’t need as many people to produce things, especially when digital products and services have a near zero marginal cost and where customers can be co-opted as free workers that don’t appear on the balance sheet.

A handful of people, especially financial speculators and those betting on the future trajectory of technology are making lots of money from this. And when regulatory frameworks are weak and geography becomes irrelevant these sums tend to multiply. For multinational firms making money is becoming easier too, not only because markets are growing, but also because huge amounts of money can be saved by using information technology to co-ordinate production across geographies.

Downstream risks

If society can be judged by how those with the most treat those with the least then things are not looking good. Five minutes walk from the solitary shark and winner takes all mentality you can find families that haven’t worked in three generations. Many of them have given up hope of ever doing so. They are irrelevant to a digital economy or, more specifically, what Manuel Castells, a professor of sociology at Berkeley, calls ‘informational capitalism.’

Japan is not far off a situation where some people will retire without ever having worked and without having moved out of the parental home. In some ways Japan is unique, for instance its resistance to immigration. But in other ways Japan offers a glimpse of what can happen when a demographic double-whammy of rapid ageing and falling fertility means that workforces shrink, pensions become unaffordable and younger generations don’t enjoy the same disposable incomes or standards of living taken for granted by their parents.

Economic uncertainty, caused partly by a shift from analogue to digital platforms, can mean that careers are delayed, which delays marriage, which feeds through to low birth rates, which lowers GDP, which fuels more economic uncertainty. This is all deeply theoretical, but the results can be hugely human.If people don’t enjoy secure employment, housing or relationships, what does this do to one’s physical and especially one’s psychological state?A few decades ago people worked in a wide range of manufacturing and service industries and collected a secure salary and benefits. But now, according to Yochai Benkler, a professor at Harvard Law School, an on-demand economy is developing that connects people selling certain skills to others looking to buy. This sounds good. It sounds entrepreneurial, efficient and flexible. But it can be savagely uncompromising.

Crowd of one

Not so long ago employees were largely shielded from the ups and downs of macroeconomics, geo-politics, technological change, ill health and misfortune by their employers. But nowadays, as companies withdraw benefits and promote flexible and zero hours contacts, individuals are out on their own. It is the companies, and their senior executives, that have been de-risked. It is they that accrue the financial benefits of the efficiencies. Individuals can’t expect much help from debt-burdened governments or weakened trade unions either. If people lack secure employment this may delay independence. The erosion of affordable education, housing, health and pensions may have more serious effects. I am not necessarily alluding to generational rebellion or revolt. I think passive disaffection and disenfranchisement are more likely. But a world that’s changing too fast for many people to understand can create incomprehension and uncertainty. It can create what Castells describes as: ‘informed bewilderment’ too. This may sound mild, but if bewilderment turns into feelings of despair and isolation there’s the chance it could feed fundamentalism.

There is also evidence emerging that enduring physical hardship and mental anguish not only create premature ageing, which compromises the immune and cardiovascular system, but that this has a lasting legacy for those people having children. This is partly because poorer individuals are more attuned to injustice, which feeds through to ill health and premature ageing, and partly because many of the subsequent diseases can be passed on genetically. But it is not relative income levels per se that so offend, but the corruption, villainy and visibility that often accompany consumption on such a vast scale. When things go badly wrong and financial losses are socialised this can be especially irksome for people too.

What people around the world want, I imagine, is fairness.This doesn’t have to mean pulling people at the top down, but it does mean pushing people at the bottom up. Moreover, if we focus attention purely on the top 1 per cent, as the Global Occupy Movement did back in 2011, we negate the need to look at our own actions and responsibilities. In the Victorian era, when wealth was also polarised, there was at least a shared moral code, broad sense of civic duty and collective responsibility. People, you might say, remained human. Nowadays, increasingly, individuals are purely looking out for themselves. This isn’t just true in the West. In China there is anguished discussion about individual callousness and a culture of compensation. The debate was initiated after the video was posted online back in 2011 when a toddler, Yue Yue, was hit by several vehicles in Foshan, a rapidly growing city in Guangdong province. (Can’t link the video in the book but here it is if you want to see it – be warned it’s horrible).Despite being clearly hurt no vehicles stopped and nobody bothered to help until a rubbish collector picked the child up. The child later died in hospital.

Such incidents are rare, but they are not unknown and do perhaps point toward moral decline. More worrying, perhaps, such events symbolise a world that is becoming more grasping and litigious, where trust and the principle of moral reciprocity are under threat. Another incident, also in China , saw two boys attempting to save two girls from drowning. The boys failed and were made to pay compensation of around 50,000 Yuan (about £5,000) each to the parents for not saving them.

Volunteering and sharing are in fine fettle, but are we becoming more nervous about about sticking our necks out for others? As for philanthropy, there’s a lot of it around, but much of it has become, as one London Museum director rather succinctly put it: ‘money laundering for the soul.’ Philanthropy is becoming an offshoot of branding. It is buildings as giant selfies, rather than the selfless and often anonymous love of humanity.

Given all of this, one wonders why we haven’t seen a new round of revolutions in the West. Thanks to digital media, we all know all about the haves and the have yachts (phrase done to death?). It’s even easy to find where the yachts are thanks to tracking apps. Then again, we barely know our own neighbours these days, living, as we increasingly do, in digital bubbles where our friends are filtered according to pre-selected criteria. The result is that we know more and more about the people and things we like, but less and less about anything, or anyone, outside of our logical preferences and illogical prejudices.

Putting aside cognitative biases such as inattentional blindness, which means we are often blissfully unaware of what’s happening in front of our own eyes, there’s also the thought that we’ve become so focussed on ourselves that focusing anger on a stranger five minutes up the road is a bit of stretch. This is especially true if you are addicted to 140 character updates of your daily existence or looking at photographs of cats online.

A lack of solid boundaries

Is anyone out there thinking about how Marx’s theory of alienation might be linked to social stratification and an erosion of humanity? I doubt it, but the fall of Communism can be connected with this behaviour, especially the dominance of individualism, the emergence of self-obsession, globalisation and free market economics.

This is because before the fall of the Berlin Wall in 1989 there was an alternative ideology and economic system that acted as a counter-weight to the excesses of capitalism, free markets and individualism. Similarly, in many countries, an agile and attentive left took the sting out of any political right hooks. Take these balancing forces away and you not only end up with tax shy billionaires, but income polarisation and casino banking. You also end up with systemic financial crashes, another of which will undoubtedly be along shortly, thanks to stratospheric levels of debt and the globally connected nature of risk. It’s possible that volatility related to connectivity will be confined to singular events, but I do worry about emotional contagion relating to relatively insignificant events and the impact that rising interest rates will surely have eventually.

Coming back to some good news, a significant trend is the growth of the global incomes. According to Ernst & Young, the accountancy firm, an additional 3 billion meat eating, car driving, fancy watch-wearing smartphone-using individuals are being added to the global middle class. In China, living standards have risen by an astonishing 10,000 per cent in a single generation. In terms of per capita GDP in China and India this has doubled in 16 and 12 years respectively. In the UK this took 153 years. This is pleasing, although this definition of middle class includes people earning as little as $10 a day, so we shouldn’t get too carried away with trickle down economics. What globalisation giveth may soon be taken away by automation and even if this newfound wealth isn’t temporary there’s plenty of research to suggest that as people grow richer they focus more attention on their own needs at the expense of others. So a wealthier world may turn out to be one that’s less caring. Moreover, in developed economies the trend might be travelling in the opposite direction with technology hollowing out of the traditional middle and professional classes, with most sinking downward towards working class or neo-feudal status rather than effervescently rising upward.

According to Pew Research, the percentage of people in the US that think of themselves as middle class fell from 53 per cent in 2008 to 44 per cent in 2014, with 40 per cent now defining themselves as lower class compared to 25 per cent in 2008. Teachers, for example, that have studied hard, worked relentlessly for decades and benefit society as a whole find themselves priced out of various markets by the relentless rise of financial speculators. Further automation could make matters worse. Martin Wolf, a Financial Times columnist comments that intelligent machines ‘could hollow out middle class jobs and compound inequality.’

Of course, it’s not numbers that matter. What counts are feelings, especially feelings related to the direction of travel. The perception that we are mostly moving in the wrong direction can be seen in areas such as education and health too, and it’s not too hard to imagine a future world split into two halves, a thin, rich, well-educated, mobile elite and an overweight, poorly educated, anchored underclass. This is reminiscent of HG Well’s intellectual, surface dwelling Eloi and downtrodden, subterranean Morlocks in The Time Machine and Tolkien’s Mines of Moria. The only difference this time might be that sharks end up living underground too.

Alternative history

It’s possible, of course, that this outcome could be re-written. It’s entirely possible that we will experience a reversal where honour and service to country are valued far above commerce. This is a situation that existed in Britain and elsewhere not that long ago. It’s possible that grace, humility, public spiritedness and contempt for vulgar displays of wealth could become dominant social values. Or perhaps a modest desire to leave as small a footprint as possible could become a key driving force. On the other hand, perhaps a dark dose of gloom and doom is exactly what the world needs.

A study led by Heejung Park at UCLA found that the trend towards greater materialism and reduced empathy had been partly reversed due to the 2008-2010 economic downturn.

In comparison with a similar study looking at the period 2004–2006, US adolescents were less concerned with owning expensive items, while the importance of having a job that’s ‘worthwhile to society’ rose. Whether this is just cyclical or part of a permanent shift is currently impossible to say. These studies partly link with previous research suggesting that a decline in economic wealth promotes collectivism and perhaps with the idea that we only truly appreciate things when we are faced with their loss. There aren’t too many upsides to global pandemics and financial meltdowns, but the threat of impending death or disaster does focus the long lens of perspective, as Steve Jobs pointed out in his commencement speech at Stamford University.

Digital ripples

How else might the digitalisation of finance impact our behaviour in the future? I think it is still too early to make any definitive statements, but research suggests that once we shift from physical to digital money (and debt) our attitudes and behaviour change.

With physical money (paper money, metal coins and cheques) we are more likely to buy into the illusion that money has inherent value. We are therefore more vigilant. In many cases, certainly my own, we are somewhat careful. Physical money feels real so our purchasing (and debt) is considered. With digital money (everything from credit and debit cards to PayPal, Apple Money, iTunes vouchers, BitCoin and so forth) our spending is more impulsive, reckless even. When money is digital and belongs to someone else this behaviour is amplified.

Cascading failure

Another consequence of digital money is connectivity. Connectivity has a whole host of benefits, but linking things together means that risks can become systemic and failure flowing throughout an entire system is a distinct possibility. I suspect that so far we have been lucky. Flash Crashes such as the one that occurred on 6 May 2010 have been isolated events. High-speed trading algorithms — algorithms being computer programs that follow certain steps to solve a problem or react to an observed situation — decided to sell vast amounts of stocks in seconds, causing momentary panic. Similar failures have occurred in power networks. Blind faith in the power and infallibility of algorithms makes such failures more likely and more severe. As Christopher Steiner, author of Automate: How Algorithms Came to Rule Or World writes: ‘We’re already halfway towards a world where algorithms run nearly everything. As their power intensifies, wealth will concentrate towards them.’ Similarly, Nicholas Carr has written that: ‘Miscalculations of risk, exacerbated by high-speed computerised trading programs, played a major role in the near meltdown of the world’s financial system in 2008.’

Given the world’s financial markets, which influence our savings and pensions, are increasingly influenced by algorithms, this is a cause for concern. After all, who is analysing the algorithms that are doing all of the analysing? Link this to the potential impacts of QE — inflation generally and asset price inflation in particular — and things are looking edgy. Asset inflation is a problem because it circles back to income polarisation. If you own hard assets, such as real estate, then moderate inflation can be a good thing because it increases the value of assets (often bought with debt, which is itself reduced via inflation). In contrast savers holding cash, or anyone without assets, is penalised.

Let’s put QE into perspective. In the US, QE had, at the time of writing, become a $3,700 billion exercise. The only reason that the US and other debt-soaked countries aren’t bankrupt is that they’ve been buying their own debt using magic money and it doesn’t need a genius to point out that this isn’t sustainable. Some of this funny money has kept a number of bankrupt banks afloat, while some has flowed into equities and some into tangible assets including commodities.

It’s a bit of a stretch to link QE to the Arab Spring, but some people have, pointing out that food price inflation was a contributory factor, which was indirectly linked to QE. If one was a conspiracy theorist one might even suggest that QEs real aim was to drive down the value of the dollar, the pound and the Euro at the expense of spiralling hard currency debt and emerging economy currencies.

In The Downfall of Money, the author Frederick Taylor notes that Germany’s hyperinflation not only destroyed the middle class, but democracy itself. As he writes, by the time inflation reached its zenith: ‘everyone wanted a dictatorship.’

The cause of Germany’s hyperinflation was initially Germany failing to keep up with payments due to France after WW1. But it was also caused by too much money chasing too few goods, which has shades of asset bubbles created by QE.

It was depression, not inflation per se, that pushed voters toward Hitler, but this has a familiar ring. Across Europe we are seeing a significant rightwards shift and one of the main reasons why Germany won’t boost the EU economy is because of the lasting trauma caused by inflation ninety years ago. If the lasting legacy of QE, debt, networked risk and a lack of financial restraint by individuals and institutions is either high inflation or continued depression things could get nasty.

The death of cash?

How about money on a longer timeline? If cash is destined for extinction what might some of the consequences be? For instance, how might the black economy operate post-cash?

Interestingly, we still tend to use cash more than we think.

In the UK, in 2012, more than half of all transactions were cash and the use of banknotes and coins rose slightly from the previous year. Why? The answer is probably that in 2012 the UK was still belt-tightening and people felt they could control their spending more easily using cash. Or perhaps people didn’t trust the banks or each other. Similarly, in rich countries, more than 90 per cent of all retail is still in physical rather than digital stores.

I was on the Greek island of Hydra in 2014 and much to my surprise the entire economy had reverted to cash. This was slightly annoying, because I had just written an article about the death of cash based on my experience of visiting the island two years earlier. On this visit almost everywhere accepted plastic (i.e. digital) money, but things had changed. Why?

I initially thought the reason was Greeks’ attempting to avoid tax, but it transpired that the real reason was trust. If you are a small business supplying meat to a taverna and you’re worried about getting paid, you ask for cash. This is one reason why cash might endure longer than some people suspect. Another reason is symbolism. Physical money tells a rich story. It symbolises a nation’s heritage in a way that digital payments cannot. I think cashless societies are ultimately inevitable, largely because digital transactions are faster and more convenient for companies. Also because governments would like to reduce illegal economic activity and collect the largest amount of tax possible.

In the US, for instance, it’s been estimated that cash costs the American economy $200 billion a year, not just due to tax evasion and theft, but also due to time wasting. A study, by Tufts University says that the average American spends 28 minutes per month traveling to ATMs, to which my reaction is so what? What are people not doing by ‘wasting’ 28 minutes going to an ATM? Writing sonnets? Inventing a cure for cancer?

Nevertheless, I suspect there is huge pent-up demand for mobile payments and money will be made trying to get rid of money. According to the UK payments council the use of cash is expected to fall by a third by 2022 and we may see a single global e-currency one day. We will certainly witness an explosion of mobile payments, using mobile devices, but also other forms of contactless (NFC) payments, pre-pay cards, private currencies, alterative currencies and embedded money. We may, one day, even place payment chips inside our bodies.

But we should be careful not to assume that everyone is like ourselves. The people most likely to use cash are elderly, poor or vulnerable, so it would be a huge banking error, in my view, if everyone stopped accepting physical money. It’s also a useful Plan B to have a stash of cash in case the economy melts down or your phone battery dies leaving you with no way to pay for dinner. This is probably swimming against the tide though.

One of the key trends we’re seeing in the global economy is dematerialisation — an analogue to digital switch. This change is good on many levels. The ability to make payments online or to buy anything from anywhere at anytime, is a wonderful development. So too are peer-to-peer loans, crowd-sourced funding for artistic endeavours and so on. There’s the dream, too, of a global digital economy that’s free from dishonest banks, avaricious speculators and regulation fixated governments.

Currencies around the world are still largely anchored to the idea of geographical boundaries and economies in which physical goods and services are exchanged. But what if someone invented a decentralised digital currency that operated independently of central banks? And what if that currency were to use encryption techniques, not only to ensure security and avoid confiscation or taxation, but also to control the production of the currency? Something like BitCoin?

Crypto-currency accounts

In one scenario, BitCoin could become not only an alternative currency, but a stateless alternative payments infrastructure, competing against the like of Apple Pay and PayPal and against alternative currencies like airline miles. But there’s a more radical possibility.

What if a country got into trouble (Greece? Italy? Argentina?) and trust in the national currency collapsed. People might seek alternative ways to make payments or keep their money safe. If enough people flocked to something like BitCoin perhaps a government might be forced to follow suit and we’d end up with a crytocurrency being used for exports, with it’s value tied to a particular economy or set of economies.

More radically, how about a currency that rewarded certain kinds of behaviour? We have this already, in a sense, with loyalty cards, but I’m thinking of something consequential. What if, for instance, the underlying infrastructure of BitCoin was used to create a currency that was distributed to people behaving in a virtuous manner? What if, for instance, money could be earned by putting more energy or water into a local network than was taken out? Or how about earning money by abstaining from the development of triple sub-basements or by visiting an elderly person that lives alone and asking them how they are? We could even pay people who smiled at strangers.

Given what governments will potentially be able to do if cash does disappear, such alternative currencies — along with old-fashioned bartering — could prove popular. At the moment, central banks use interest rates as the main weapon to control or stimulate the economy. But if people hoard cash because interest rates are low — or because they don’t trust banks — then the economy is stunted. But with a cashless society the government has another weapon in its arsenal.What if banks not only charged people for holding money (negative interest rates) but governments imposed an additional levy for not spending it? This is making my head spin so we should move on to explore the brave new world of healthcare and medicine, of which money is an enabler.

But before we do I’d like to end this chapter on pensions and taxation. This probably sounds deathly dull, but it’s important, so please pay attention. If economic conditions are good, I’d imagine that money and payments will continue to migrate toward digital. Alternatives to banks will spring up and governments will loosen their tax-take. However, if austerity persists then governments will do everything they can to get hold of more of your money — but they will be less inclined to spend it, especially on services. Taxation based upon income and expenditure will continue, but I expect that it will shift towards assets and wealth and to some extent behaviour.

One of the effects of moving toward digital payments and connectivity is transparency. Governments will be able to see what you’re spending money on, but also how you’re living in a broader sense. Hence stealth taxation. Have you put the wrong type of plastic in the recycling bin again? That’s a fine (tax). Kids late for school again? Fine (tax). Burger and large fries? You get the idea…

Governments will seek to not only maximise revenue, but nudge people toward certain behaviours and people will be forced to pay for the tiniest transgressions. This, no doubt, will spark rage and rebellion, but they’ll be a tax for that too. As for pensions, there are several plausible scenarios, but business as usual isn’t one of them. The system is largely bust and needs to be reinvented. What comes next largely depends on whether we continue to seek instant gratification and whether or not responsibility for the future is shared individually or collectively. If the culture of individualism and instant rewards holds firm, we’ll end up with a very low safety net or a situation where people never fully retire. If we are able to delay gratification, we’ll end up either with a return to a savings culture or one where the state provides significant support in return for significant contributions.

The bottom line here is that pensions are set firmly in the future for many people, and while we like thinking about the future, we don’t like paying for it. So what might happen that would change the world for the better and make things more sustainable in an economic sense?

In 1973, EF Schumacher’s book Small is Beautiful warned against the dangers of ‘gigantism.’ On one level the book was a pessimistic polemic about modernity in general and globalisation in particular. On the other hand it was prescient and predictive. Schumacher foresaw the problem of resource constraints and foreshadowed the issue of human happiness, which he believed could not be sated by material possessions.

He also argued for human satisfaction and pleasure to be central to all work, mirroring the thoughts of William Morris and the Arts and Crafts Movement. They argued that since consumer demand was such a central driver of the economy, then one way to change the world for the better would be to change our collective tastes and values.

On one level Schumacher’s book is still an idealistic hippy homily. On another it manages to describe our enduring desire for human scale, human relationships and technology that is appropriate, controllable and above all understandable. Schumacher specifically warned against the concentration of economic and political power, which he believed would lead to dehumanisation. Decisions should therefore be made on the basis of basic human need rather than the requirements of distantly accountable corporations and governments.

What would Schumacher make our current economic situation? Maybe he’d see the present day as the start of something nasty. Maybe the beginning of something beautiful. What I suspect he would point out is that many people feel that they have lost control of their lives, especially financially. Job insecurity, austerity, debt and a lack of secure pensions make people anxious and this can have physical effects. According to a study published in the medical magazine The Lancet, economic conditions can make people and their genetic dependants sick. Putting to one side the increased risk of suicide, mental health is a major casualty of economic and geopolitical conditions. Psychological stress means that our bodies are flooded with stress hormones and these can make us ill.

Economic conditions can also make long lasting changes to our genes, which can be a catalyst for heart disease, cancer and depression in later generations. Another study, co-led by George Slavich at the University of California at Los Angeles, says that there is historical evidence for such claims and cites the fact that generations born during recessions tend to have unusually short lifespans.

Research with monkeys (Jenny Tung at Duke in North Carolina for instance) also suggests that if people perceive that they have a lower social rank, the more active their pro-inflammatory genes become.Even the anticipation of future bad news or events may trigger such changes, which might explain why I recently heard that the shark in Notting Hill is now on medication.