Just FYI, anyone that’s interested in HPC, super-computing, advanced modelling & simulation, problems, prediction, cyber-security and any associated field might be interested in this. It’s on Thursday 23 February in London. Event link here.

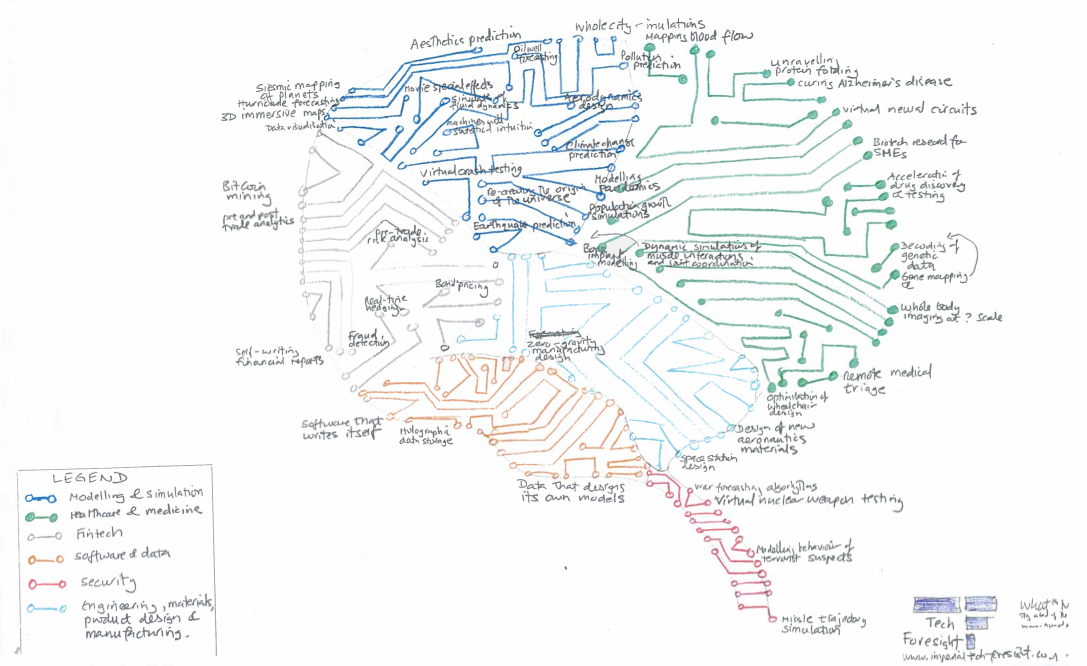

Beginning of a new Current & Future uses of HPC map below….

Current & Future Applications of HPC

Modelling & Simulation

Preventing the invention of unnecessary

Prediction of technology breakthroughs

Modelling specific species against climate change

Dynamic longevity prediction

Predicting M&A activity/hostile takeovers

Lifelike recreation of dead actors in movies

Volcano modelling

Real time national mood modelling

Hyper-local personal weather forecasts

Complete human brain simulations

Prediction of social unrest using global social media feeds

Finding holes in existing research

Finding new knowledge in Big Data

Automation of scientific research

Radiation shield modelling

Molecular dynamics modelling

Space weather forecasting

Trawling scientific data to find genetically applicable treatments

Molecular dynamics forecasting

Automation of scientific research

Aesthetics prediction

Seismic mapping of planets

Hurricane forecasting

Modelling of tornado trajectory & speed

Galaxy simulations

Oil well forecasting

Movie special effects

Simulation of fluid dynamics

Virtual crash testing

Re-creation of the origin of the universe

Earthquake prediction

Population growth simulations

Climate change modelling

Aerodynamics design

Whole city simulations

Pollution forecasting

Radiation shield modelling

Molecular dynamics modelling

Modelling impacts of bio-diversity loss

Power grid simulation & testing

Modelling of organizational behaviour

Optimization of citywide traffic flows

Emergency room simulation

Major incident modelling & simulation

Space weather forecasting

Healthcare & Medicine

Dynamic real-time individual longevity forecasts

Mapping blood flow

Prediction of strokes, brain injury & vascular brain disease

Pandemic modelling

Unravelling protein folding

Curing Alzheimer’s disease

Virtual neural circuits

Bio-tech research for SMEs

Acceleration of drug discovery & testing

Decoding of genetic data

Whole body imaging at scale

Remote medical triage

Foreign aid & disaster relief allocation

Dynamic simulations of muscle & joint interactions

Bone implant modelling

Modelling of the nervous system

Longevity prediction at birth

Design of super efficient water filters

Fintech

Pre-trade risk analysis

Bond pricing

Real-time hedging

Fraud detection

Self-writing financial reports

Automatic regulatory control & compliance

Pre and post-trade analysis

Dynamic allocation of government tax revenues

News prediction

Flash crash prediction

Optimisation of investment strategies

Automated hiring & firing of employees

Automated due diligence for M&A

Whole economy simulation

Software & data

Software that writes itself

Holographic data storage

Coding for ultra-low energy use

Data that generates its own models

Engineering, materials & manufacturing

Space station design

Space colony design

Design of new aeronautics materials

Zero gravity manufacturing & design

Predicting properties of undiscovered materials

Design of smart cities

Identification of redundant assets

Optimization of just in time manufacturing

Optimization of crowd-sourced delivery networks

Design of ‘impossible’ buildings & structures

Security

Recording of every individual human conversation on earth

Modelling of factors likely to lead to a revolution

Deliberate cyber-facilitation of revolutions

Breaking 512-bit encryption ciphers

War forecasting algorhythms

Virtual nuclear weapon testing

Modelling behaviour of terrorist suspects

Crime prediction down to individual streets

Identification of terrorist suspects

Forecasting of geo-political upheavals

Hyper-realistic war gaming

Simulation of large scale cyber attacks

Missile trajectory simulation

Screening of data from multiple spectra & media in real time

Threat detection

Crisis management decision support

Note: This is just me going off on a bit of a jazz riff at the moment. All subject to change!