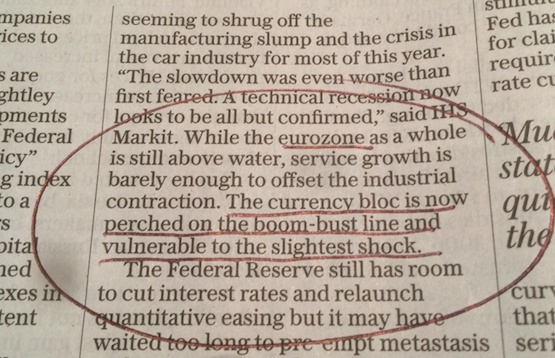

My joke 3 years ago that the EU might fall apart before Britain had left is starting to look semi-serious. I do believe that the world, especially Europe and the US, is one shock away from a major meltdown. This could be triggered by a a major political or economic event or triggered by irrational emotional contagion. Fasten your seat belts folks, the ride is about to get bumpy.

My joke 3 years ago that the EU might fall apart before Britain had left is starting to look semi-serious. I do believe that the world, especially Europe and the US, is one shock away from a major meltdown. This could be triggered by a a major political or economic event or triggered by irrational emotional contagion. Fasten your seat belts folks, the ride is about to get bumpy.

Category Archives: Europe

BREXIT Wildcards

A couple of things nobody seems to be thinking about. First, there have been calls for a second EU referendum for a while and the prospect seems more serious with the Labour Party perhaps backing the idea at, or before, the next election. The idea, and it’s a weak one in my view, is that people didn’t quite know what they were voting for last time or people were misled. Sounds just like any election I can remember. But what if there is a second vote and the result is leave again? Then what? The assumption seems to be that a second vote would result in a different result. Not necessarily.

My second wildcard thought is what happens if we have a financial meltdown before 31st October? Could this create an EU collapse before Britain has left the EU?

There’s a book called the Levelling by Michael O’Sullivan, an analyst at Credit Suisse, and in it he argues that globalisation has stopped, Economic growth is weak to non-existent and the next natural dip is long overdue in countries like the US and China. Central banks have accumulated too much power, QE is distorting markets, especially bonds, and is creating a generational divide too through asset price inflation, notably housing. The banking system is still under-regulated (shadow banking is hardly regulated at all) and the big tech companies are too dominant financially. World debt stands at 320% of GDP and risk is networked throughout the entire system. One tiny spark could ignite everything.

Where is this heading? A serious change of direction most probably. I think there’s a 50:50 chance of a global crash either next month (it’s generally October!) or spring 2020 and what will governments ,and the EU in particular, do in such a situation? They have no tools left to use, except, perhaps, for negative interest rates and taxation based upon wealth not just income and that would be explosive. You might create inflation to dilute the debt, but we’ve seen where that ends up.

From Future Files (2006)

EU referendum result

The Future of Europe

I see that the French President, Francois Hollande, has stated that the crisis within Europe is “now over.” Non. These were written on the back on an envelope recently and I’ve made no attempt at driving forces or a matrix, but I quite like them.

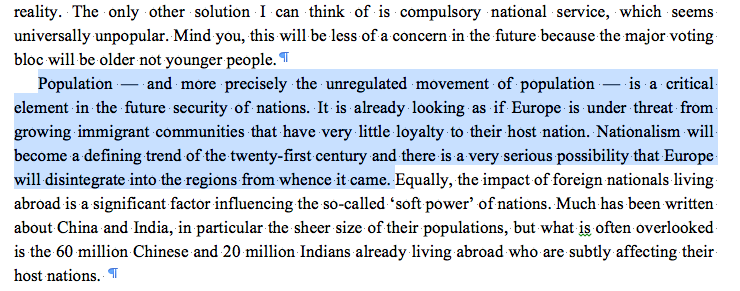

Scenario 1. Disorderly collapse

Growing inequality brought on by unemployment and income polarization create civil unrest and extreme nationalism aimed primarily at anyone that is not seen as being part of the group (i.e. local). Taxation and fines widely seen as unfair make matters worse. Outward migration rises (especially of younger people) while the impacts of rapid ageing start to be felt. The result is that EU competitiveness declines, which together with a flight from the Euro leads to a break-up of the European Union. The German economy goes into a nosedive as exports within former EU region become prohibitively expensive.

Scenario 2. Muddling through

Without tackling any of the fundamental issues such as competitiveness, the EU project carries on with token concessions to the growth agenda reducing the impact of austerity measures. The ECB muddles through, soothing the impact of various country debt dramas. Economic performance and competitiveness is variable, but generally sluggish and the US, China, India and Russia and others start to bottom feed on various EU assets fuelling an inevitable local backlash.

Scenario 3. Greater unification exposes differences

The EU attempts to stabilize itself by expanding geographically and by attempting to increase economic and social integration. However, expansion and unification merely expose fundamental differences between the European north, south, west and east. Migration into key member states increases exposing hidden tribal and xenophobic tendencies. Things carry on for years, but eventually the project collapses under its own bureaucratic weight.

Scenario 4. Smaller but stronger

Following the national bankruptcy and EU exist of (select one or more from the following: Portugal, Italy, Greece or Spain) and the virtual exit by the UK, a new union is created by France and Germany with Benelux annexed. This results is a more dynamic union with greater fiscal and social unification, although disagreements persist.

Scenario 5. Accidental winner

Serious US and Asian economic problems, most notably in China, result in the Euro replacing the US dollar and aspirant Yen as the international currency. This results in inward investment, economic growth and a fall in unemployment across the region. Long-standing disagreements and structural difficulties are forgotten.