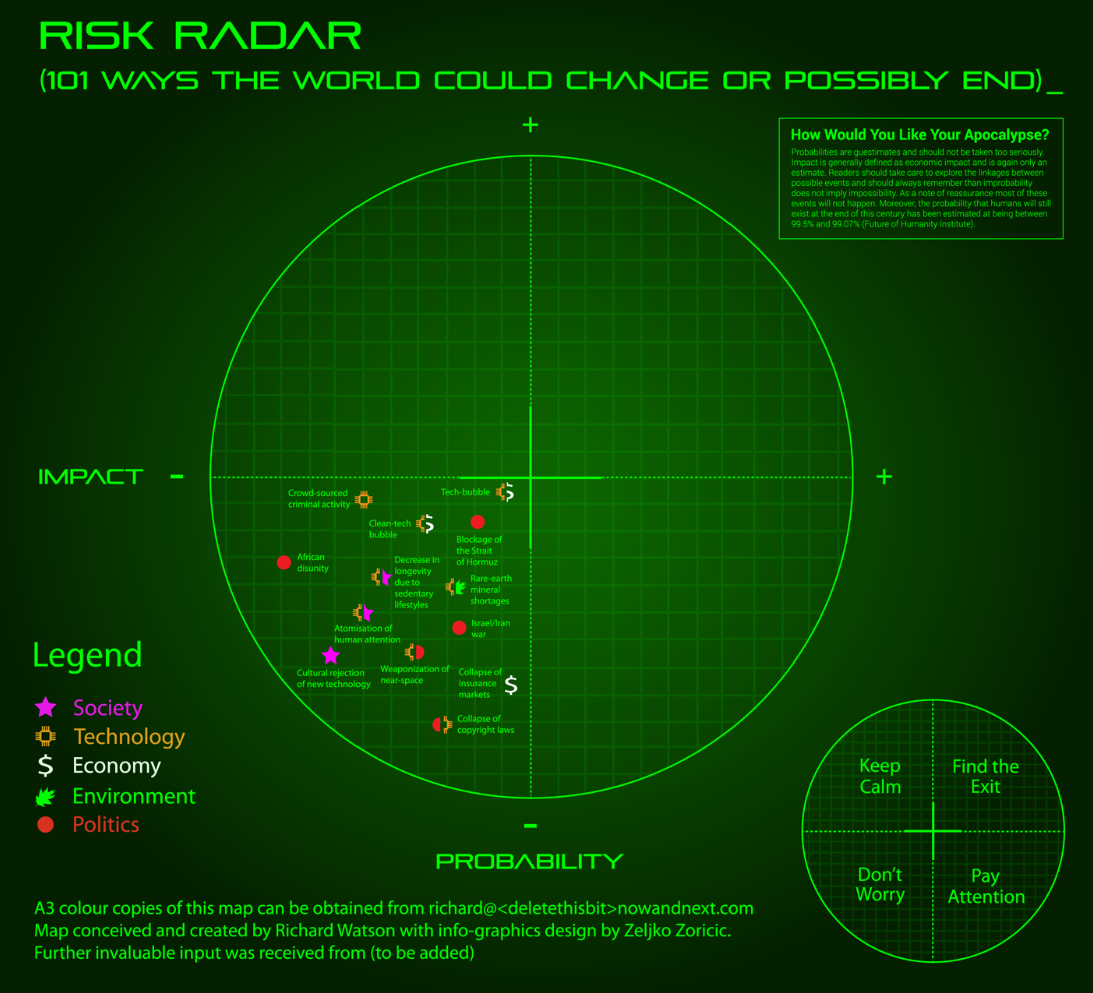

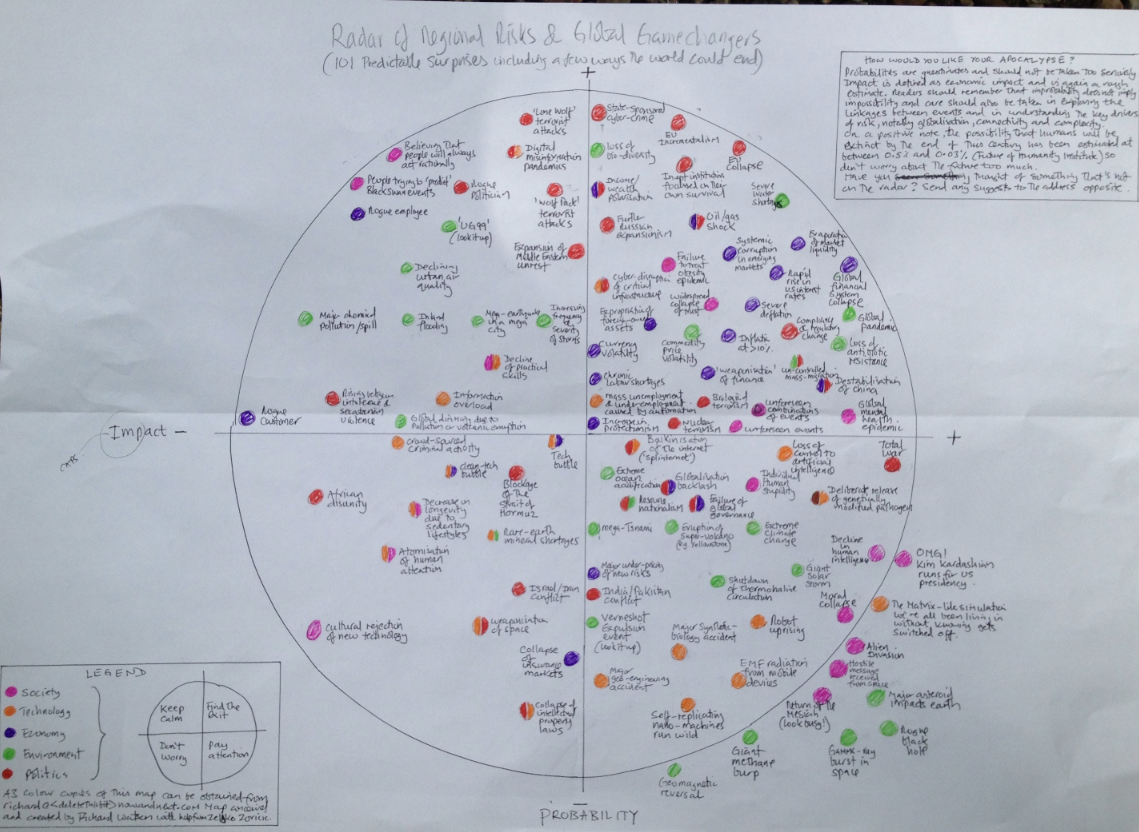

Interesting news yesterday. The focus was very much on Greece, as you might expect, although what was happening in China was possibly a far bigger story and one that links to something I’ve got on my new risk map (early draft above).

If you missed it (which if you live in Europe you may well have) $3.2 trillion has been wiped off the value of the Chinese stock market in just three weeks. This may be linked to concerns about Greece, but there’s a far bigger story here in my view and one that I’ve been talking about for the past five years.

China currently has an export-orientated model. That’s fine, but it makes China hugely vulnerable to external economic shocks (such as Europe), especially when you have an imbalance of young men in the population.

It’s a bit like in that film speed, where there’s a bomb on a bus that will detonate if the bus travels at less than 50 miles per hour. China needs a certain growth rate (people used to say 8% but the figure is probably far lower than this) to keep its people happy.

If people in China (especially young men) have got jobs, homes and the prospect of buying things like cars then everyone is happy. But of Europe falls over economically this could send shock waves across China. In short the unspoken deal done by the government whereby people can get as rich as they like if they don’t criticise the ruling party blows up. People (especially young men) could be thrown out of work and potentially their homes. Hey Presto, Tiananmen Square the sequel, but this time with an overlay of social media.

Maybe that’s why the Chinese internal security budget exceeds its external defence budget. That’s what worries China!